Form D1 - Dayton D1 Declaration Of Estimated Tax

ADVERTISEMENT

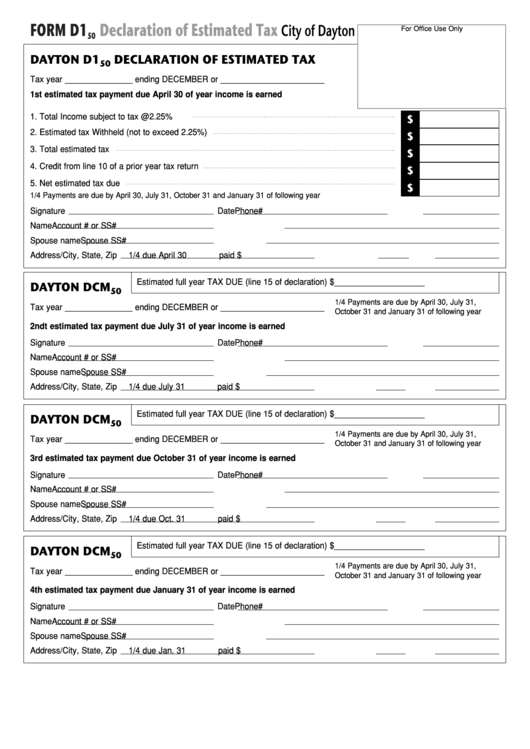

FORM D1

Declaration of Estimated Tax

City of Dayton

For Office Use Only

50

DAYTON D1

DECLARATION OF ESTIMATED TAX

50

Tax year _______________ ending DECEMBER or _______________________

1st estimated tax payment due April 30 of year income is earned

1. Total Income subject to tax

@2.25%

$

2. Estimated tax Withheld (not to exceed 2.25%)

$

3. Total estimated tax

$

4. Credit from line 10 of a prior year tax return

$

5. Net estimated tax due

$

1/4 Payments are due by April 30, July 31, October 31 and January 31 of following year

Signature

Date

Phone#

Name

Account # or SS#

Spouse name

Spouse SS#

Address/City, State, Zip

1/4 due April 30

paid $

Estimated full year TAX DUE (line 15 of declaration) $____________________

DAYTON DCM

50

1/4 Payments are due by April 30, July 31,

Tax year _______________ ending DECEMBER or _______________________

October 31 and January 31 of following year

2ndt estimated tax payment due July 31 of year income is earned

Signature

Date

Phone#

Name

Account # or SS#

Spouse name

Spouse SS#

Address/City, State, Zip

1/4 due July 31

paid $

Estimated full year TAX DUE (line 15 of declaration) $____________________

DAYTON DCM

50

1/4 Payments are due by April 30, July 31,

Tax year _______________ ending DECEMBER or _______________________

October 31 and January 31 of following year

3rd estimated tax payment due October 31 of year income is earned

Signature

Date

Phone#

Name

Account # or SS#

Spouse name

Spouse SS#

Address/City, State, Zip

1/4 due Oct. 31

paid $

Estimated full year TAX DUE (line 15 of declaration) $____________________

DAYTON DCM

50

1/4 Payments are due by April 30, July 31,

Tax year _______________ ending DECEMBER or _______________________

October 31 and January 31 of following year

4th estimated tax payment due January 31 of year income is earned

Signature

Date

Phone#

Name

Account # or SS#

Spouse name

Spouse SS#

Address/City, State, Zip

1/4 due Jan. 31

paid $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1