Publication 584-B - Business, Casualty, Disaster, And Theft Loss Workbook

ADVERTISEMENT

Introduction

Publication 584-B

(Rev. December 2005)

This workbook is designed to help you figure

Cat. No. 31749K

your loss on business and income-producing

Department

property in the event of a disaster, casualty, or

of the

Business

theft. It contains schedules to help you figure the

Treasury

loss to your office furniture and fixtures, informa-

Internal

tion systems, motor vehicles, office supplies,

Revenue

Casualty,

buildings, and equipment. These schedules,

Service

however, are for your information only. You

must complete Form 4684, Casualties and

Thefts, to report your loss.

Disaster, and

Theft Loss

How To Use This

Workbook

Workbook

You can use this workbook by following these

five steps.

1. Read Publication 547 to learn about the

tax rules for casualties, disasters, and

thefts.

2. Know the definitions of adjusted basis and

fair market value, discussed below.

3. Fill out Schedules 1 through 6.

4. Read the instructions for Form 4684.

5. Fill out Form 4684 using the information

you entered in Schedules 1 through 6.

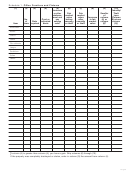

Use the chart below to find out how to use

Schedules 1 through 6 to fill out Form 4684.

And enter it on

Take what’s in...

Form 4684...

Column 1 . . . . . . . . . . . . . . . . . . . Line 22

Column 2 . . . . . . . . . . . . . . . . . . . Line 22

Column 3 . . . . . . . . . . . . . . . . . . . Line 22

Column 4 . . . . . . . . . . . . . . . . . . . Line 23

Column 5 . . . . . . . . . . . . . . . . . . . Line 24

Column 6 . . . . . . . . . . . . . . . . . . . Line 26

Column 7 . . . . . . . . . . . . . . . . . . . Line 27

Column 8 . . . . . . . . . . . . . . . . . . . Line 28

Column 9 . . . . . . . . . . . . . . . . . . . Line 29

Column 10 . . . . . . . . . . . . . . . . . . Line 30

Adjusted basis. Adjusted basis usually

means original cost plus improvements, minus

depreciation allowed or allowable (including any

section 179 expense deduction), amortization,

depletion, etc. If you did not acquire the property

by purchasing it, your basis is determined as

discussed in Publication 551, Basis of Assets.

Fair market value. Fair market value is the

price for which you could sell your property to a

willing buyer, when neither of you has to sell or

buy and both of you know all the relevant facts.

When filling out Schedules 1 through 6, you

need to know the fair market value of the prop-

erty immediately before and immediately after

the disaster or casualty.

Deduction limits. If your casualty or theft loss

involved a home you used for business or rented

out, your deductible loss may be limited. See the

Get forms and other information

instructions for Section B of Form 4684. If the

casualty or theft loss involved property used in a

faster and easier by:

passive activity, see Form 8582, Passive Activ-

Internet •

ity Loss Limitations, and its instructions.

The casualty and theft loss deduction for

employee property, when added to your job ex-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8