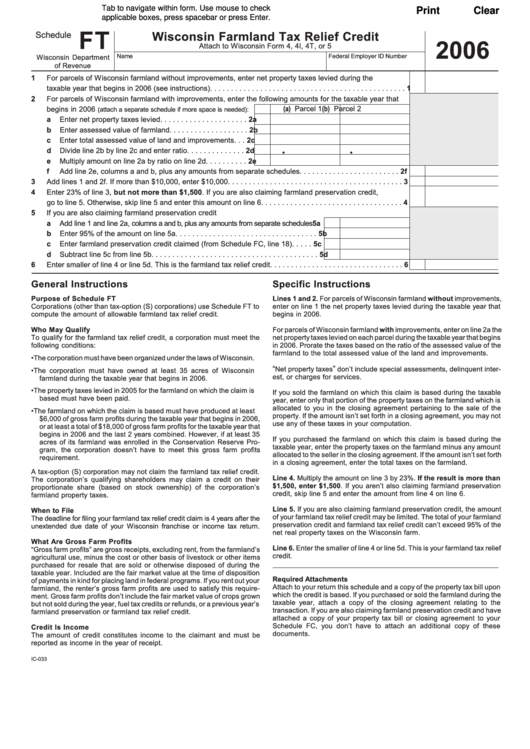

Tab to navigate within form. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

FT

Wisconsin Farmland Tax Relief Credit

Schedule

2006

Attach to Wisconsin Form 4, 4I, 4T, or 5

Name

Federal Employer ID Number

Wisconsin Department

of Revenue

1

For parcels of Wisconsin farmland without improvements, enter net property taxes levied during the

taxable year that begins in 2006 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

For parcels of Wisconsin farmland with improvements, enter the following amounts for the taxable year that

(a) Parcel 1

(b) Parcel 2

begins in 2006

(attach a separate schedule if more space is needed):

a

Enter net property taxes levied . . . . . . . . . . . . . . . . . . . . .

2a

b

Enter assessed value of farmland . . . . . . . . . . . . . . . . . . .

2b

c

Enter total assessed value of land and improvements . . .

2c

d

Divide line 2b by line 2c and enter ratio . . . . . . . . . . . . . .

2d

•

•

e

Multiply amount on line 2a by ratio on line 2d . . . . . . . . . .

2e

f

Add line 2e, columns a and b, plus any amounts from separate schedules . . . . . . . . . . . . . . . . . . . . . . . .

2f

3

Add lines 1 and 2f. If more than $10,000, enter $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Enter 23% of line 3, but not more than $1,500. If you are also claiming farmland preservation credit,

go to line 5. Otherwise, skip line 5 and enter this amount on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

If you are also claiming farmland preservation credit

a

Add line 1 and line 2a, columns a and b, plus any amounts from separate schedules

5a

b

Enter 95% of the amount on line 5a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

c

Enter farmland preservation credit claimed (from Schedule FC, line 18) . . . . .

5c

d

Subtract line 5c from line 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5d

6

Enter smaller of line 4 or line 5d. This is the farmland tax relief credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

General Instructions

Specific Instructions

Purpose of Schedule FT

Lines 1 and 2. For parcels of Wisconsin farmland without improvements,

Corporations (other than tax-option (S) corporations) use Schedule FT to

enter on line 1 the net property taxes levied during the taxable year that

compute the amount of allowable farmland tax relief credit.

begins in 2006.

Who May Qualify

For parcels of Wisconsin farmland with improvements, enter on line 2a the

To qualify for the farmland tax relief credit, a corporation must meet the

net property taxes levied on each parcel during the taxable year that begins

following conditions:

in 2006. Prorate the taxes based on the ratio of the assessed value of the

farmland to the total assessed value of the land and improvements.

• The corporation must have been organized under the laws of Wisconsin.

“

”

Net property taxes

don’t include special assessments, delinquent inter-

• The corporation must have owned at least 35 acres of Wisconsin

est, or charges for services.

farmland during the taxable year that begins in 2006.

• The property taxes levied in 2005 for the farmland on which the claim is

If you sold the farmland on which this claim is based during the taxable

based must have been paid.

year, enter only that portion of the property taxes on the farmland which is

allocated to you in the closing agreement pertaining to the sale of the

• The farmland on which the claim is based must have produced at least

property. If the amount isn’t set forth in a closing agreement, you may not

$6,000 of gross farm profits during the taxable year that begins in 2006,

use any of these taxes in your computation.

or at least a total of $18,000 of gross farm profits for the taxable year that

begins in 2006 and the last 2 years combined. However, if at least 35

If you purchased the farmland on which this claim is based during the

acres of its farmland was enrolled in the Conservation Reserve Pro-

taxable year, enter the property taxes on the farmland minus any amount

gram, the corporation doesn’t have to meet this gross farm profits

allocated to the seller in the closing agreement. If the amount isn’t set forth

requirement.

in a closing agreement, enter the total taxes on the farmland.

A tax-option (S) corporation may not claim the farmland tax relief credit.

Line 4. Multiply the amount on line 3 by 23%. If the result is more than

The corporation’s qualifying shareholders may claim a credit on their

$1,500, enter $1,500. If you aren’t also claiming farmland preservation

proportionate share (based on stock ownership) of the corporation’s

credit, skip line 5 and enter the amount from line 4 on line 6.

farmland property taxes.

Line 5. If you are also claiming farmland preservation credit, the amount

When to File

of your farmland tax relief credit may be limited. The total of your farmland

The deadline for filing your farmland tax relief credit claim is 4 years after the

preservation credit and farmland tax relief credit can’t exceed 95% of the

unextended due date of your Wisconsin franchise or income tax return.

net real property taxes on the Wisconsin farm.

What Are Gross Farm Profits

Line 6. Enter the smaller of line 4 or line 5d. This is your farmland tax relief

“Gross farm profits” are gross receipts, excluding rent, from the farmland’s

credit.

agricultural use, minus the cost or other basis of livestock or other items

purchased for resale that are sold or otherwise disposed of during the

taxable year. Included are the fair market value at the time of disposition

Required Attachments

of payments in kind for placing land in federal programs. If you rent out your

Attach to your return this schedule and a copy of the property tax bill upon

farmland, the renter’s gross farm profits are used to satisfy this require-

which the credit is based. If you purchased or sold the farmland during the

ment. Gross farm profits don’t include the fair market value of crops grown

taxable year, attach a copy of the closing agreement relating to the

but not sold during the year, fuel tax credits or refunds, or a previous year’s

transaction. If you are also claiming farmland preservation credit and have

farmland preservation or farmland tax relief credit.

attached a copy of your property tax bill or closing agreement to your

Schedule FC, you don’t have to attach an additional copy of these

Credit Is Income

documents.

The amount of credit constitutes income to the claimant and must be

reported as income in the year of receipt.

IC-033

1

1