Reset Form

Print Form

Iowa Department of Revenue

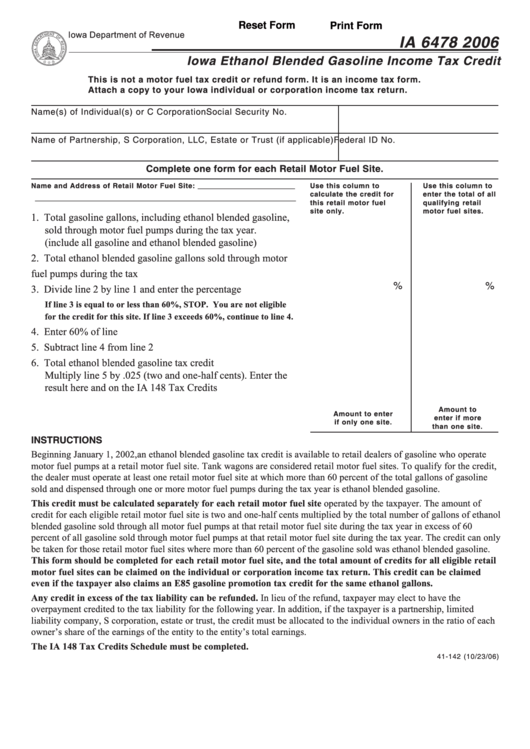

IA 6478 2006

Iowa Ethanol Blended Gasoline Income Tax Credit

This is not a motor fuel tax credit or refund form. It is an income tax form.

Attach a copy to your Iowa individual or corporation income tax return.

Name(s) of Individual(s) or C Corporation

Social Security No.

Name of Partnership, S Corporation, LLC, Estate or Trust (if applicable) Federal ID No.

Complete one form for each Retail Motor Fuel Site.

Name and Address of Retail Motor Fuel Site: _________________________

Use this column to

Use this column to

calculate the credit for

enter the total of all

___________________________________________________________________

this retail motor fuel

qualifying retail

site only.

motor fuel sites.

1. Total gasoline gallons, including ethanol blended gasoline,

sold through motor fuel pumps during the tax year.

(include all gasoline and ethanol blended gasoline) ............... 1. _________________

_______________

2. Total ethanol blended gasoline gallons sold through motor

fuel pumps during the tax year. ............................................... 2. _________________

_______________

%

%

3. Divide line 2 by line 1 and enter the percentage here ............. 3. _________________

_______________

If line 3 is equal to or less than 60%, STOP. You are not eligible

for the credit for this site. If line 3 exceeds 60%, continue to line 4.

4. Enter 60% of line 1 ................................................................. 4. _________________

_______________

5. Subtract line 4 from line 2 ...................................................... 5. _________________

_______________

6. Total ethanol blended gasoline tax credit

Multiply line 5 by .025 (two and one-half cents). Enter the

result here and on the IA 148 Tax Credits Schedule............... 6. _________________

_______________

Amount to

Amount to enter

enter if more

if only one site.

than one site.

INSTRUCTIONS

Beginning January 1, 2002, an ethanol blended gasoline tax credit is available to retail dealers of gasoline who operate

motor fuel pumps at a retail motor fuel site. Tank wagons are considered retail motor fuel sites. To qualify for the credit,

the dealer must operate at least one retail motor fuel site at which more than 60 percent of the total gallons of gasoline

sold and dispensed through one or more motor fuel pumps during the tax year is ethanol blended gasoline.

This credit must be calculated separately for each retail motor fuel site operated by the taxpayer. The amount of

credit for each eligible retail motor fuel site is two and one-half cents multiplied by the total number of gallons of ethanol

blended gasoline sold through all motor fuel pumps at that retail motor fuel site during the tax year in excess of 60

percent of all gasoline sold through motor fuel pumps at that retail motor fuel site during the tax year. The credit can only

be taken for those retail motor fuel sites where more than 60 percent of the gasoline sold was ethanol blended gasoline.

This form should be completed for each retail motor fuel site, and the total amount of credits for all eligible retail

motor fuel sites can be claimed on the individual or corporation income tax return. This credit can be claimed

even if the taxpayer also claims an E85 gasoline promotion tax credit for the same ethanol gallons.

Any credit in excess of the tax liability can be refunded. In lieu of the refund, taxpayer may elect to have the

overpayment credited to the tax liability for the following year. In addition, if the taxpayer is a partnership, limited

liability company, S corporation, estate or trust, the credit must be allocated to the individual owners in the ratio of each

owner’s share of the earnings of the entity to the entity’s total earnings.

The IA 148 Tax Credits Schedule must be completed.

41-142 (10/23/06)

1

1