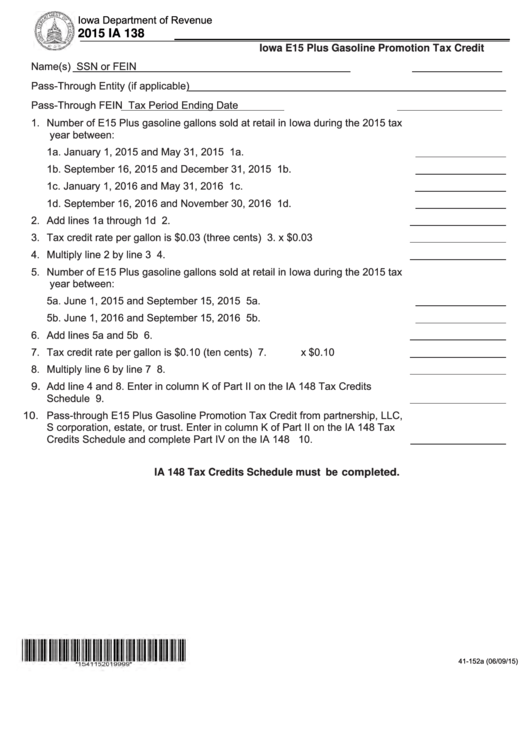

Iowa Department of Revenue

https://tax.iowa.gov

2015 IA 138

Iowa E15 Plus Gasoline Promotion Tax Credit

Name(s)

SSN or FEIN

Pass-Through Entity (if applicable)

Pass-Through FEIN

Tax Period Ending Date

1. Number of E15 Plus gasoline gallons sold at retail in Iowa during the 2015 tax

year between:

1a. January 1, 2015 and May 31, 2015 .............................................................. 1a.

1b. September 16, 2015 and December 31, 2015 ............................................. 1b.

1c. January 1, 2016 and May 31, 2016 .............................................................. 1c.

1d. September 16, 2016 and November 30, 2016 ............................................. 1d.

2. Add lines 1a through 1d ........................................................................................ 2.

3. Tax credit rate per gallon is $0.03 (three cents) ................................................... 3.

x $0.03

4. Multiply line 2 by line 3 .......................................................................................... 4.

5. Number of E15 Plus gasoline gallons sold at retail in Iowa during the 2015 tax

year between:

5a. June 1, 2015 and September 15, 2015 ........................................................ 5a.

5b. June 1, 2016 and September 15, 2016 ........................................................ 5b.

6. Add lines 5a and 5b .............................................................................................. 6.

7. Tax credit rate per gallon is $0.10 (ten cents) ....................................................... 7.

x $0.10

8. Multiply line 6 by line 7 .......................................................................................... 8.

9. Add line 4 and 8. Enter in column K of Part II on the IA 148 Tax Credits

Schedule ............................................................................................................... 9.

10. Pass-through E15 Plus Gasoline Promotion Tax Credit from partnership, LLC,

S corporation, estate, or trust. Enter in column K of Part II on the IA 148 Tax

Credits Schedule and complete Part IV on the IA 148 ...................................... 10.

IA 148 Tax Credits Schedule must be completed.

41-152a (06/09/15)

1

1 2

2