Form Ia 4562a - Iowa Depreciation Adjustment Schedule - 2006 Page 2

ADVERTISEMENT

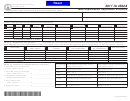

PART III - Summary of adjustments to net income

If you file

Enter positive amounts

Enter negative amounts

1. Enter the sum of amounts from

1.

Part I, columns E & F

Iowa Form:

from line 5 on:

from line 5 on:

1040

Other Income, line 14

Other Income, line 14

2. Enter the sum of amounts from

2.

Part I, columns H & I

1065

Part I, line 3

Part I, line 6

3. Adjustment to depreciation

1120

Schedule A, depreciation adj., line 8

Schedule A, depreciation adj., line 8

3.

(subtract line 2 from line 1)

1120A

Schedule A, other additions, line 4

Schedule A, other reductions, line 4

4. Enter amount from

4.

1120S

Schedule S, line 3

Schedule S, line 7

Part II, column F

1120F

Schedule A, line 7

Schedule D, line 7

5. Add lines 3 and 4

5.

INSTRUCTIONS

This form must be completed by any taxpayer who claimed the 30%

but beginning prior to January 1, 2006, for which Section 179 expense in

“bonus depreciation” deduction for assets acquired after September 10,

excess of $25,000 was taken for federal tax purposes, and you chose to claim

2001, but before May 6, 2003, provided under the Job Creation and Worker

no more than $25,000 for Iowa tax purposes. A separate schedule can be

attached listing all qualifying property. Grouping of assets by class is also

Assistance Act of 2002. This form should be used whether depreciation was

claimed on Federal Form 4562, Depreciation and Amortization; Federal

permitted. For example, all 3-year assets, all 5-year assets, etc., may be

Form 2106, Employee Business Expenses; Schedule C, Profit or Loss from

grouped together. If assets are grouped, the taxpayer is responsible to

Business; Schedule F, Profit or Loss from Farming, or any other Federal

maintain all records necessary to support how each item was grouped.

Compute the amount of Federal depreciation using the “bonus depreciation”

form where depreciation was deducted.

This form must also be completed by any taxpayer who disposes of 30%

method and the amount of Iowa depreciation using the MACRS method

“bonus depreciation” property during the tax year, and Iowa depreciation

without any “bonus depreciation and using a limit of $25,000 on Section 179

adjustments were made to the property in previous tax years. This form must

property, if applicable. Total the amount of the Federal depreciation in

Columns E and F and the Iowa depreciation in Columns H and I and enter on

also be completed if a taxpayer claimed 50% “bonus depreciation” for assets

acquired after May 5, 2003, but before January 1, 2005, for Federal tax

Part III of the form. The accumulated depreciation amount in columns G and

purposes, but chose not to claim this for Iowa tax purposes. In addition, this

J should include the total amounts of depreciation and Section 179 expense

form must be completed if a taxpayer claims the Federal Section 179

for the life of the asset(s).

If you have not sold or disposed of any “bonus depreciation” property, you

expense in excess of $25,000 for tax years beginning on or after January 1,

may skip Part II of this form.

2003, but beginning before January 1, 2006, and taxpayer chose to only

claim no more than $25,000 for Iowa tax purposes.

Starting with tax years beginning on or after January 1, 2006, taxpayers

PART II If you sold or disposed of “bonus depreciation” property this

year, and the Iowa depreciation adjustment applied to the property in any

must claim the same section 179 expense that was claimed on the Federal

prior years, you must make the applicable depreciation catch-up adjustment

return.

to adjust the basis of the property for Iowa purposes. A separate schedule can

PART I List each item of property acquired after September 10, 2001, but

be attached listing all qualifying sales or dispositions, and grouping of assets

before May 5, 2003, for which 30% “bonus depreciation” was claimed on

by class is also permitted as described in Part I. Total the amount in Column

F and enter on Part III of the form.

the Federal return. Also, list property acquired after May 5, 2003, but before

January 1, 2005, for which the 50% “bonus depreciation” was claimed for

Federal tax purposes that you chose not to claim for Iowa tax purposes. In

PART III Compute the net adjustment from Part I and Part II. Enter the

addition, list property for tax years beginning on or after January 1, 2003,

amount from line 5 on the applicable Iowa form as noted above.

41-105b (8/9/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2