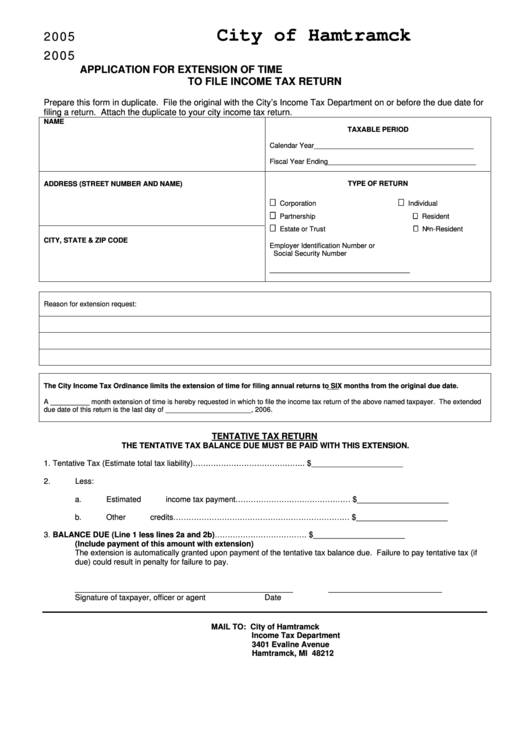

Application For Extension Of Time To File Income Tax Return - City Of Hamtramck - 2005

ADVERTISEMENT

2005

City of Hamtramck

2005

APPLICATION FOR EXTENSION OF TIME

TO FILE INCOME TAX RETURN

Prepare this form in duplicate. File the original with the City’s Income Tax Department on or before the due date for

filing a return. Attach the duplicate to your city income tax return.

NAME

TAXABLE PERIOD

Calendar Year_________________________________________

Fiscal Year Ending______________________________________

ADDRESS (STREET NUMBER AND NAME)

TYPE OF RETURN

Corporation

Individual

Partnership

Resident

Estate or Trust

Non-Resident

CITY, STATE & ZIP CODE

Employer Identification Number or

Social Security Number

____________________________________

Reason for extension request:

The City Income Tax Ordinance limits the extension of time for filing annual returns to SIX months from the original due date.

A __________ month extension of time is hereby requested in which to file the income tax return of the above named taxpayer. The extended

due date of this return is the last day of ______________________, 2006.

TENTATIVE TAX RETURN

THE TENTATIVE TAX BALANCE DUE MUST BE PAID WITH THIS EXTENSION.

1.

Tentative Tax (Estimate total tax liability)……………………………………..

$_____________________

2.

Less:

a.

Estimated income tax payment………………………………………

$_____________________

b.

Other credits……………………………………………………………

$_____________________

3.

BALANCE DUE (Line 1 less lines 2a and 2b)………………………………

$_____________________

(Include payment of this amount with extension)

The extension is automatically granted upon payment of the tentative tax balance due. Failure to pay tentative tax (if

due) could result in penalty for failure to pay.

__________________________________________________

__________________________

Signature of taxpayer, officer or agent

Date

MAIL TO: City of Hamtramck

Income Tax Department

3401 Evaline Avenue

Hamtramck, MI 48212

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1