Form 765-2004 - Virginia Unified Nonresident Income Tax Return

ADVERTISEMENT

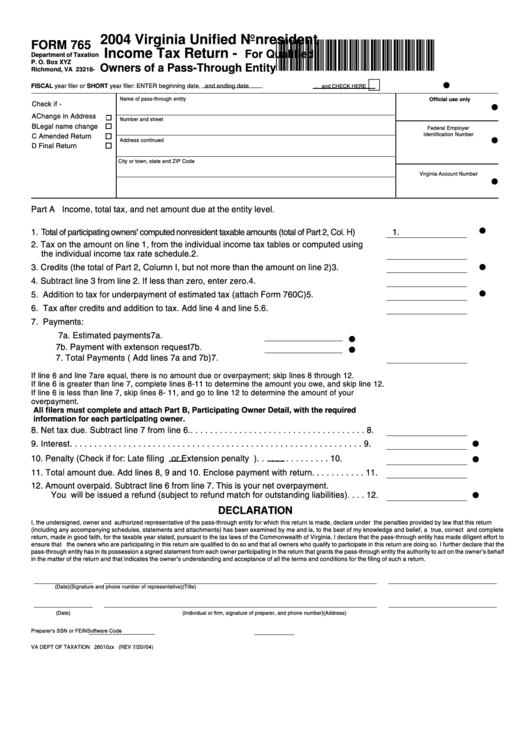

2004 Virginia Unified Nonresident

*VA0765104000*

FORM 765

Income Tax Return -

For Qualified

Department of Taxation

P. O. Box XYZ

Owners of a Pass-Through Entity

Richmond, VA 23218-

j

w

FISCAL year filer or SHORT year filer: ENTER beginning date

and ending date

,

, and CHECK HERE

Name of pass-through entity

Official use only

Check if -

w

A Change in Address

Number and street

B Legal name change

Federal Employer

Identification Number

C Amended Return

w

Address continued

D Final Return

City or town, state and ZIP Code

Virginia Account Number

w

Part A Income, total tax, and net amount due at the entity level.

w

1. Total of participating owners' computed nonresident taxable amounts (total of Part 2, Col. H)

1.

2. Tax on the amount on line 1, from the individual income tax tables or computed using

the individual income tax rate schedule.

2.

w

3. Credits (the total of Part 2, Column I, but not more than the amount on line 2)

3.

4. Subtract line 3 from line 2. If less than zero, enter zero.

4.

w

5. Addition to tax for underpayment of estimated tax (attach Form 760C)

5.

6. Tax after credits and addition to tax. Add line 4 and line 5.

6.

7. Payments:

7a. Estimated payments

7a.

w

7b. Payment with extenson request

7b.

w

7. Total Payments ( Add lines 7a and 7b)

7.

If line 6 and line 7are equal, there is no amount due or overpayment; skip lines 8 through 12.

If line 6 is greater than line 7, complete lines 8-11 to determine the amount you owe, and skip line 12.

If line 6 is less than line 7, skip lines 8- 11, and go to line 12 to determine the amount of your

overpayment.

All filers must complete and attach Part B, Participating Owner Detail, with the required

information for each participating owner.

8. Net tax due. Subtract line 7 from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

w

9. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Penalty (Check if for: Late filing

or Extension penalty

) . . . . . . . . . . . . . . . 10.

w

11. Total amount due. Add lines 8, 9 and 10. Enclose payment with return . . . . . . . . . . . 11.

12. Amount overpaid. Subtract line 6 from line 7. This is your net overpayment.

w

You will be issued a refund (subject to refund match for outstanding liabilities). . . . 12.

DECLARATION

I, the undersigned, owner and authorized representative of the pass-through entity for which this return is made, declare under the penalties provided by law that this return

(including any accompanying schedules, statements and attachments) has been examined by me and is, to the best of my knowledge and belief, a true, correct and complete

return, made in good faith, for the taxable year stated, pursuant to the tax laws of the Commonwealth of Virginia. I declare that the pass-through entity has made diligent effort to

ensure that the owners who are participating in this return are qualified to do so and that all owners who qualify to participate in this return are doing so. I further declare that the

pass-through entity has in its possession a signed statement from each owner participating in the return that grants the pass-through entity the authority to act on the owner's behalf

in the matter of the return and that indicates the owner's understanding and acceptance of all the terms and conditions for the filing of such a return.

____________________

_____________________________________________________________________________________________

_____________________________________

(Date)

(Signature and phone number of representative)

(Title)

____________________

_____________________________________________________________________________________________

_____________________________________

(Date)

(Individual or firm, signature of preparer, and phone number)

(Address)

Preparer's SSN or FEIN

Software Code

VA DEPT OF TAXATION 26010zx (REV 7/20//04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2