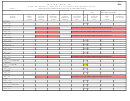

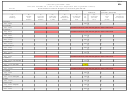

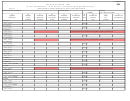

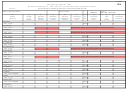

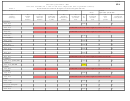

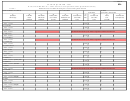

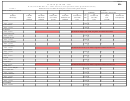

Form 85a - Kansas Schedule 1 - Ifta Fuel Tax Computation (Ifta Qualified Vehicles) - 2007 Page 4

ADVERTISEMENT

FORM

85A

SECOND QUARTER - 2007

KANSAS SCHEDULE 1 - IFTA Fuel Tax Computation (IFTA Qualified Vehicles)

PAGE 4

Round amounts in Columns B through F to nearest whole gallon and mile

NAME AS SHOWN ON FORM 85

IFTA License Number

Tax Period

GASOLINE

April 1, 2007 - June 30, 2007

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

Jurisdiction

Total Miles

Total Taxable

Taxable Gallons

Total Gallons

Net Taxable Gals

Tax

Tax Due/Credit

Interest

Total Due/Credit

and Fuel Type

in each

Miles in each

(Col. C divided

Purchased in each

(Col. D minus

Rate

(Col. F times

at 1%

(Col. H plus Col. I)

Jurisdiction

Jurisdiction

by AMG )

Jurisdiction

Col. E)

Col. G)

per month

50 ALBERTA

.2900 $

$

$

51002

Gasoline

51 BRITISH COLUMBIA

.4671 $

$

$

52002 Gasoline

52 MANITOBA

.3705 $

$

$

53002

Gasoline

53 NEW BRUNSWICK

.3447 $

$

$

54002

Gasoline

59 NEWFOUNDLAND

.5315 $

$

$

60002 Gasoline

57 NOVA SCOTIA

58002

Gasoline

.4993 $

$

$

54 ONTARIO

.4735 $

$

$

55002

Gasoline

58 PRINCE EDWARD

.6540 $

$

$

59002

Gasoline

55 QUEBEC

.4896 $

$

$

56002

Gasoline

56 SASKATCHEWAN

.4832 $

$

$

57002

Gasoline

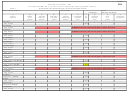

91 91002

All Other

Jurisdictions

92 92002 TOTALS

PLEASE TOTAL ALL COLUMNS DOWN FOR LINE 92/92002

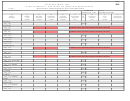

****************

Total for column (E 92/92002) must match column

****************

Total for column (B 92/92002) should match column

(B) on front of your return for Total miles traveled

(C) on front of your return for Total gallons purchased

in all jurisdictions.

in all jurisdictions.

Be sure to follow through on next page, and fill out any Surcharge's that apply for those states traveled.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5