Schedule 502a - Multistate Pass-Through Entity - 2005

ADVERTISEMENT

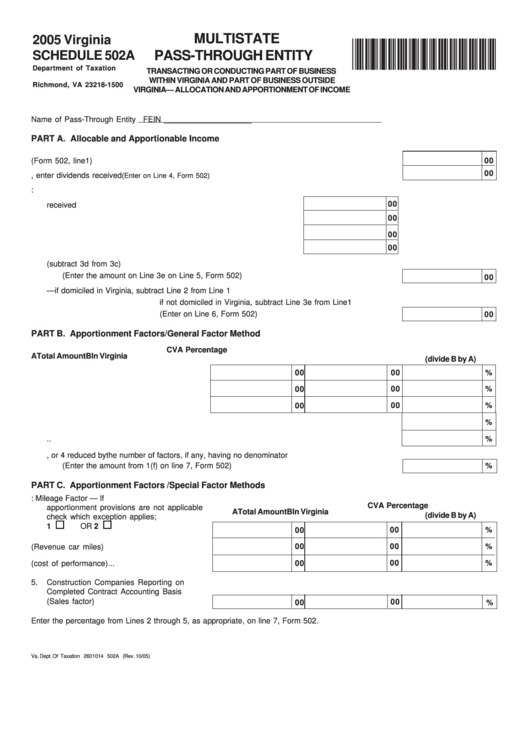

MULTISTATE

2005 Virginia

*VA502A105000*

PASS-THROUGH ENTITY

SCHEDULE 502A

Department of Taxation

TRANSACTING OR CONDUCTING PART OF BUSINESS

P.O. Box 1500

WITHIN VIRGINIA AND PART OF BUSINESS OUTSIDE

Richmond, VA 23218-1500

VIRGINIA— ALLOCATION AND APPORTIONMENT OF INCOME

Name of Pass-Through Entity

FEIN ____________________

PART A. Allocable and Apportionable Income

1.

Total of taxable income amounts (Form 502, line1) .................................................................................

00

00

2.

If commercial domicile is in Virginia, enter dividends received

(Enter on Line 4, Form 502) .........................

3.

If commercial domicile is not in Virginia:

00

3a. Enter dividends received ....................................................................

00

3b. Enter nonapportionable investment function income ........................

3c. Add 3a and 3b .....................................................................................

00

00

3d. Enter nonapportionable investment function loss .............................

3e. Allocable income (subtract 3d from 3c)

(Enter the amount on Line 3e on Line 5, Form 502) .........................................................................

00

4.

Apportionable Income — if domiciled in Virginia, subtract Line 2 from Line 1

if not domiciled in Virginia, subtract Line 3e from Line1

(Enter on Line 6, Form 502) ..................................................................

00

PART B. Apportionment Factors/General Factor Method

1.

Three Factor Method

C VA Percentage

A Total Amount

B In Virginia

C

(divide B by A)

1a. Property factor ............................................

00

00

%

1b. Payroll factor ...............................................

00

00

%

1c. Sales factor ................................................

00

%

00

1d. Enter sales factor from Line 1c. Sales factor is double weighted ....................................................

%

1e. Sum of percentages in Lines 1a through 1d .....................................................................................

%

1f. Line 1e divided by 4, or 4 reduced by the number of factors, if any, having no denominator

(Enter the amount from 1(f) on line 7, Form 502) .............................................................................

%

PART C. Apportionment Factors /Special Factor Methods

2.

Motor Carriers: Mileage Factor — If

C VA Percentage

apportionment provisions are not applicable

A Total Amount

B In Virginia

C

(divide B by A)

check which exception applies;

1

OR

2

.............................

00

00

%

00

00

%

3.

Railway Companies (Revenue car miles) .......

4.

Financial Companies (cost of performance) ...

00

00

%

5.

Construction Companies Reporting on

Completed Contract Accounting Basis

(Sales factor) ....................................................

00

00

%

Enter the percentage from Lines 2 through 5, as appropriate, on line 7, Form 502.

Va. Dept. Of Taxation 2601014 502A (Rev. 10/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1