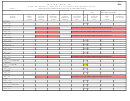

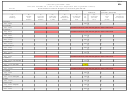

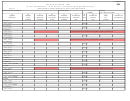

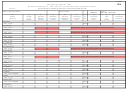

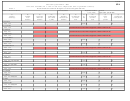

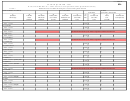

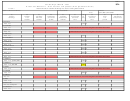

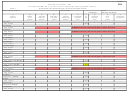

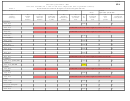

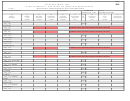

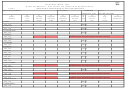

Form 85a - Kansas Schedule 1 - Ifta Fuel Tax Computation (Ifta Qualified Vehicles) - 2007 Page 5

ADVERTISEMENT

SURCHARGE

FORM

85A

SECOND QUARTER - 2007

KANSAS SCHEDULE 1 - IFTA Fuel Tax Computation (IFTA Qualified Vehicles)

PAGE 5

Round amounts in Columns B through F to nearest whole gallon and mile

NAME AS SHOWN ON FORM 85

COMPRESSED

IFTA License Number

Tax Period

NATURAL GAS (CNG)

April 1, 2007 - June 30, 2007

(A)

(D)

(G)

(H)

(I)

(J)

Jurisdiction

Taxable Gallons

Tax

Tax Due

Interest

Total Due

and Fuel Type

Reported in

Rate

(Col. D times

at 1%

(Col. H plus Col. I)

(Col. D)

Col. G)

per month

14 INDIANA

Total ( taxable gals col. D)

.1100 $

$

$

90005 Surcharge

in Indiana x rate

16 KENTUCKY

Total ( taxable gals col. D)

90005 Surcharge

in Kentucky x rate

.0690 $

$

$

45 VIRGINIA

Total ( taxable gals col. D)

.0350 $

$

$

90005 Surcharge

in Virginia x rate

$

$

$

If you have completed line 14 (Indiana), line 16 (Kentucky), or line 45 (Virginia) you must complete the above surcharge line.

Total Columns H, I, & J

Enter the taxable gallon figures from the diesel schedule (col. D) for Indiana, Kentucky,and Virginia. Multiply the taxable gallons from each state times the tax rate.

Do not include the tax due from surcharges when calculating the total tax due (column H) for line 92005. Add the tax due (column H) for line 92005 to the tax due (column H)

from surcharges and transfer this total, and the total from any other fuel schedule completed, to line 12 of Form 85. FOR EXAMPLE: If you have tax due for CNG

on line 92005 in the amount of $100.00 and tax due from surcharges in the amount of $10.00 (Indiana), $12.00 (Kentucky) and $5.00 (Virginia), you would transfer the amount

of $127.00 to line 12 of Form 85.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5