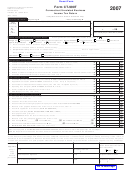

City of Fairfield Business Income Tax Return 2007 Page 2

All appropriate Federal schedules and forms MUST be attached. A return is NOT complete unless schedules and forms are included.

Schedule X – Reconciliation with Federal Income Tax Return

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

A.

Capital Losses (Sec 1231 included)……… $ ___________

H. Capital Gains ……………………………….............

$ ___________

B.

Income Taxes ………………………………... $ ___________

I. Intangible Income ……………………………..........

$ ___________

C.

Guaranteed Payments or Accruals to or

J. Other exempt income (Explain)

for current or former partners or members $ ___________

D.

Expenses Attributable to Non-taxable

….......…..……………………………………………. $ ___________

Income ……………………………………….....$ ___________

….......…..……………………………………………. $ ___________

E.

Real Estate Investment Trust Distributions.. $ ___________

….......…..……………………………………………. $ ___________

F.

Other.............……………………………….. $ ___________

……………………………………………….. $ ___________

……………………………………………….. $ ___________

**

K. Total Deductions …………………………...............

$ ___________

**

G.

Total Additions ………………………………....$ ___________

**

L. Combine Lines G and K, enter on Line 2 ............

$ ___________

Schedule Y – Business Apportionment Formula

A. Located

B. Located

Everywhere

In Fairfield

C. Percentage (B/A)

**

0

Step 1.

Original Cost of Real & Tangible Personal Property

_______________

_______________

_______________

%

0

**

Gross Annual Rentals Paid Multiplied by 8

_______________

_______________

_______________

%

0

**

Total Step 1.

_______________

_______________

_______________

%

Step 2.

Gross Receipts from Sales Made and/or Work or

0

**

Services Performed

_______________

_______________

_______________

%

0

**

Step 3.

Wages, Salaries and Other Compensation

_______________

_______________

_______________

%

0

**

Step 4.

Total Percentages

_______________

%

0

**

Step 5.

Average Percentage (Divide Total Percentage by Number of Percentages Used, enter on Line 3A)

______________ %

Leased Employees

Are any employees leased in the year covered by this return?

Yes

No

If Yes, please provide the name, address and FID number of the leasing company _______________________________________________________

______________________________________________________________________________________________________________________________________

Extension Policy

Extensions may, upon request, be granted for filing of the annual return, provided an IRS extension has been secured. EXTENSION REQUESTS

MUST BE MADE IN WRITING AND RECEIVED BY THIS TAX OFFICE BEFORE THE ORIGINAL DUE DATE OF THE RETURN. Only those extension requests

received in duplicate with a self-addressed, postpaid envelope will have a copy returned after being appropriately marked.

1

1 2

2