Extension And Payment Of Tax Form - City Of Monroe - 2007

ADVERTISEMENT

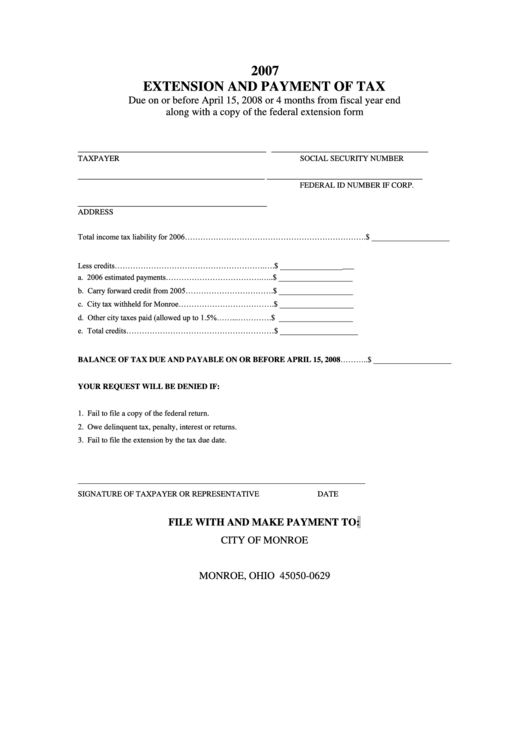

2007

EXTENSION AND PAYMENT OF TAX

Due on or before April 15, 2008 or 4 months from fiscal year end

along with a copy of the federal extension form

____________________________________

______________________________

TAXPAYER

SOCIAL SECURITY NUMBER

________________________________________________

________________________________________

FEDERAL ID NUMBER IF CORP.

________________________________________________

ADDRESS

Total income tax liability for 2006…………………………………………………………….$ ____________________

Less credits………………………………………………….….$ ___________________

a. 2006 estimated payments……………………………….…..$ ___________________

b. Carry forward credit from 2005…………………………….$ ___________________

c. City tax withheld for Monroe……………………………….$ ___________________

d. Other city taxes paid (allowed up to 1.5%……...………….$ ___________________

e. Total credits…………………………………………………$ ____________________

BALANCE OF TAX DUE AND PAYABLE ON OR BEFORE APRIL 15, 2008………..$ ____________________

YOUR REQUEST WILL BE DENIED IF:

1. Fail to file a copy of the federal return.

2. Owe delinquent tax, penalty, interest or returns.

3. Fail to file the extension by the tax due date.

_________________________________________________________________________

SIGNATURE OF TAXPAYER OR REPRESENTATIVE

DATE

FILE WITH AND MAKE PAYMENT TO:

CITY OF MONROE

P.O. BOX 629

MONROE, OHIO 45050-0629

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1