Form W-3me - Reconciliation Of Maine Income Tax Withheld In 2010

ADVERTISEMENT

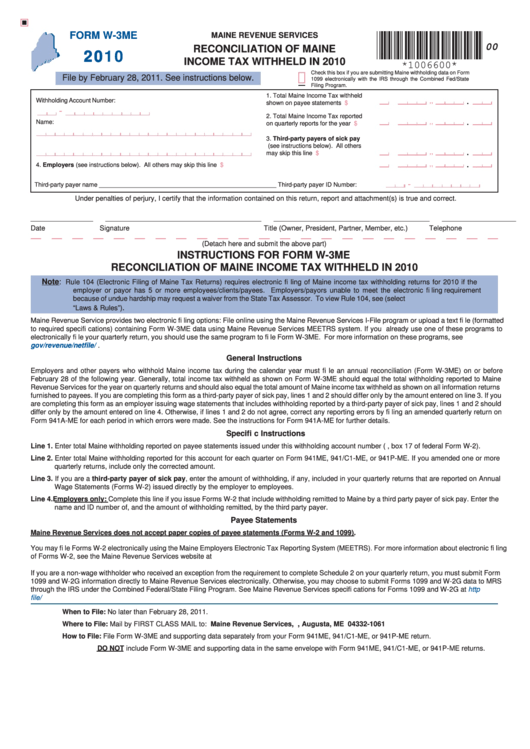

FORM W-3ME

MAINE REVENUE SERVICES

00

2010

RECONCILIATION OF MAINE

INCOME TAX WITHHELD IN 2010

*1006600*

Check this box if you are submitting Maine withholding data on Form

File by February 28, 2011. See instructions below.

1099 electronically with the IRS through the Combined Fed/State

Filing Program.

1. Total Maine Income Tax withheld

Withholding Account Number:

,

,

.

shown on payee statements

............$

-

2. Total Maine Income Tax reported

,

,

Name:

.

on quarterly reports for the year

......$

3. Third-party payers of sick pay

(see instructions below). All others

,

,

.

may skip this line

.............................$

,

,

.

4. Employers (see instructions below). All others may skip this line

.........................................................................................$

-

Third-party payer name ____________________________________________________

Third-party payer ID Number:

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

________________

________________________________________

________________________________________

___________________

Date

Signature

Title (Owner, President, Partner, Member, etc.)

Telephone

(Detach here and submit the above part)

INSTRUCTIONS FOR FORM W-3ME

RECONCILIATION OF MAINE INCOME TAX WITHHELD IN 2010

Note:

Rule 104 (Electronic Filing of Maine Tax Returns) requires electronic fi ling of Maine income tax withholding returns for 2010 if the

employer or payor has 5 or more employees/clients/payees. Employers/payors unable to meet the electronic fi ling requirement

because of undue hardship may request a waiver from the State Tax Assessor. To view Rule 104, see

(select

.

“Laws & Rules”)

Maine Revenue Service provides two electronic fi ling options: File online using the Maine Revenue Services I-File program or upload a text fi le (formatted

to required specifi cations) containing Form W-3ME data using Maine Revenue Services MEETRS system. If you already use one of these programs to

electronically fi le your quarterly return, you should use the same program to fi le Form W-3ME. For more information on these programs, see

gov/revenue/netfi

le/gateway2.htm.

General Instructions

Employers and other payers who withhold Maine income tax during the calendar year must fi le an annual reconciliation (Form W-3ME) on or before

February 28 of the following year. Generally, total income tax withheld as shown on Form W-3ME should equal the total withholding reported to Maine

Revenue Services for the year on quarterly returns and should also equal the total amount of Maine income tax withheld as shown on all information returns

furnished to payees. If you are completing this form as a third-party payer of sick pay, lines 1 and 2 should differ only by the amount entered on line 3. If you

are completing this form as an employer issuing wage statements that includes withholding reported by a third-party payer of sick pay, lines 1 and 2 should

differ only by the amount entered on line 4. Otherwise, if lines 1 and 2 do not agree, correct any reporting errors by fi ling an amended quarterly return on

Form 941A-ME for each period in which errors were made. See the instructions for Form 941A-ME for further details.

Specifi c Instructions

Line 1. Enter total Maine withholding reported on payee statements issued under this withholding account number (e.g., box 17 of federal Form W-2).

Line 2. Enter total Maine withholding reported for this account for each quarter on Form 941ME, 941/C1-ME, or 941P-ME. If you amended one or more

quarterly returns, include only the corrected amount.

Line 3. If you are a third-party payer of sick pay, enter the amount of withholding, if any, included in your quarterly returns that are reported on Annual

Wage Statements (Forms W-2) issued directly by the employer to employees.

Line 4. Employers only: Complete this line if you issue Forms W-2 that include withholding remitted to Maine by a third party payer of sick pay. Enter the

name and ID number of, and the amount of withholding remitted, by the third party payer.

Payee Statements

Maine Revenue Services does not accept paper copies of payee statements (Forms W-2 and 1099).

You may fi le Forms W-2 electronically using the Maine Employers Electronic Tax Reporting System (MEETRS). For more information about electronic fi ling

of Forms W-2, see the Maine Revenue Services website at

If you are a non-wage withholder who received an exception from the requirement to complete Schedule 2 on your quarterly return, you must submit Form

1099 and W-2G information directly to Maine Revenue Services electronically. Otherwise, you may choose to submit Forms 1099 and W-2G data to MRS

through the IRS under the Combined Federal/State Filing Program. See Maine Revenue Services specifi cations for Forms 1099 and W-2G at

maine.gov/revenue/netfi le/gateway2.htm.

When to File:

No later than February 28, 2011.

Where to File:

Mail by FIRST CLASS MAIL to: Maine Revenue Services, P.O. Box 1061, Augusta, ME 04332-1061

How to File:

File Form W-3ME and supporting data separately from your Form 941ME, 941/C1-ME, or 941P-ME return.

DO NOT include Form W-3ME and supporting data in the same envelope with Form 941ME, 941/C1-ME, or 941P-ME returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1