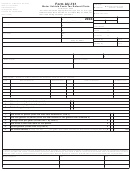

Form An 2004(2.2) - Quarterly List Of Distributors For Motor Vehicle Fuels Tax Purposes Form Page 7

ADVERTISEMENT

Further Information: Call DRS during business hours, Monday through Friday:

•

1-800-382-9463 (in-state), or

•

860-297-5962 (from anywhere)

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling 860-297-4911.

Forms and Publications: Forms and publications are anytime by:

•

Internet: Preview and download forms and publications from the DRS Web site at

•

DRS TAX-FAX: Call 860-297-5698 from the handset attached to your fax machine and select from the menu.

Only forms (not publications) are available through TAX-FAX.

•

Telephone: Call 860-297-4753 (from anywhere), or 1-800-382-9463 (in-state) and select Option 2 from a

touch-tone phone.

Paperless Filing Methods (fast, easy, free, and confidential):

•

For business returns: Use Fast-File to file sales and use taxes, business use tax, room occupancy tax, estimated

corporation tax, business entity tax, or withholding tax returns over the Internet. Visit the DRS Web site at

and click on File/Register OnLine.

•

For resident income tax returns: Use WebFile to file personal income tax returns over the Internet. Visit the

DRS Web site at and click on File/Register OnLine.

AN 2004 (2.2)

Motor Vehicle Fuels Tax

Motor Vehicle Fuels Tax Distributors

Issued: 09/14/2004

Page 7 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7