Form St3 Tl - 2005 - Request For Transfer Of Vendor'S License - Ohio Department Of Taxation

ADVERTISEMENT

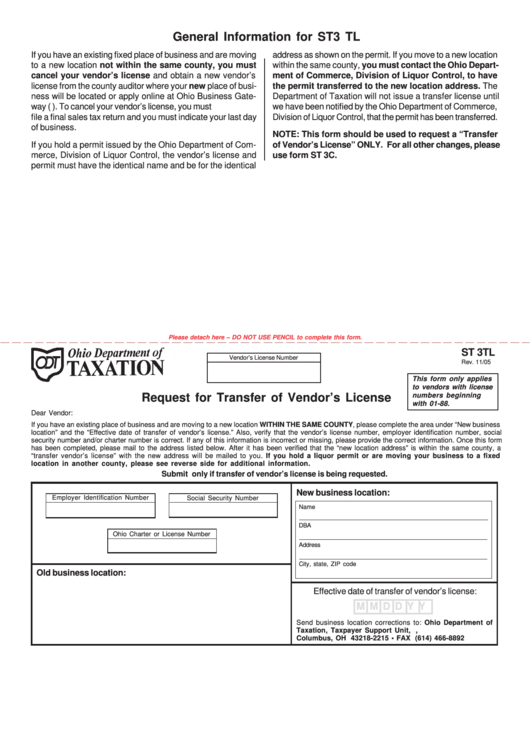

General Information for ST3 TL

If you have an existing fixed place of business and are moving

address as shown on the permit. If you move to a new location

to a new location not within the same county, you must

within the same county, you must contact the Ohio Depart-

cancel your vendor’s license and obtain a new vendor’s

ment of Commerce, Division of Liquor Control, to have

license from the county auditor where your new place of busi-

the permit transferred to the new location address. The

ness will be located or apply online at Ohio Business Gate-

Department of Taxation will not issue a transfer license until

way (obg.ohio.gov). To cancel your vendor’s license, you must

we have been notified by the Ohio Department of Commerce,

file a final sales tax return and you must indicate your last day

Division of Liquor Control, that the permit has been transferred.

of business.

NOTE: This form should be used to request a “Transfer

If you hold a permit issued by the Ohio Department of Com-

of Vendor’s License” ONLY. For all other changes, please

merce, Division of Liquor Control, the vendor’s license and

use form ST 3C.

permit must have the identical name and be for the identical

Reset Form

Please detach here – DO NOT USE PENCIL to complete this form.

ST 3TL

Vendor’s License Number

Rev. 11/05

This form only applies

to vendors with license

Request for Transfer of Vendor’s License

numbers beginning

with 01-88.

Dear Vendor:

If you have an existing place of business and are moving to a new location WITHIN THE SAME COUNTY, please complete the area under “New business

location” and the “Effective date of transfer of vendor’s license.” Also, verify that the vendor’s license number, employer identification number, social

security number and/or charter number is correct. If any of this information is incorrect or missing, please provide the correct information. Once this form

has been completed, please mail to the address listed below. After it has been verified that the “new location address” is within the same county, a

“transfer vendor’s license” with the new address will be mailed to you. If you hold a liquor permit or are moving your business to a fixed

location in another county, please see reverse side for additional information.

Submit only if transfer of vendor’s license is being requested.

New business location:

Employer Identification Number

Social Security Number

Name

DBA

Ohio Charter or License Number

Address

City, state, ZIP code

Old business location:

Effective date of transfer of vendor’s license:

M M D D Y Y

Send business location corrections to: Ohio Department of

Taxation, Taxpayer Support Unit, P.O. Box 182215,

Columbus, OH 43218-2215 • FAX (614) 466-8892

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1