Form Au-208 - Qualified Investment Company (Qic) Report

ADVERTISEMENT

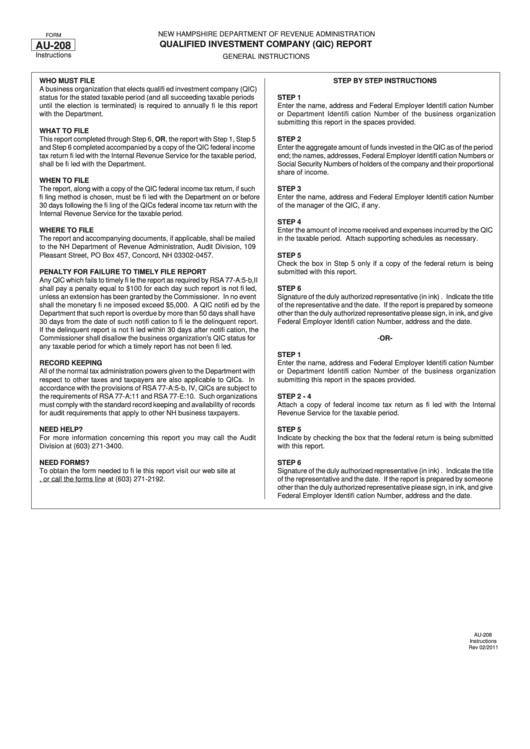

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

QUALIFIED INVESTMENT COMPANY (QIC) REPORT

AU-208

Instructions

GENERAL INSTRUCTIONS

WHO MUST FILE

STEP BY STEP INSTRUCTIONS

A business organization that elects qualifi ed investment company (QIC)

status for the stated taxable period (and all succeeding taxable periods

STEP 1

until the election is terminated) is required to annually fi le this report

Enter the name, address and Federal Employer Identifi cation Number

with the Department.

or Department Identifi cation Number of the business organization

submitting this report in the spaces provided.

WHAT TO FILE

This report completed through Step 6, OR, the report with Step 1, Step 5

STEP 2

and Step 6 completed accompanied by a copy of the QIC federal income

Enter the aggregate amount of funds invested in the QIC as of the period

tax return fi led with the Internal Revenue Service for the taxable period,

end; the names, addresses, Federal Employer Identifi cation Numbers or

shall be fi led with the Department.

Social Security Numbers of holders of the company and their proportional

share of income.

WHEN TO FILE

The report, along with a copy of the QIC federal income tax return, if such

STEP 3

fi ling method is chosen, must be fi led with the Department on or before

Enter the name, address and Federal Employer Identifi cation Number

30 days following the fi ling of the QICs federal income tax return with the

of the manager of the QIC, if any.

Internal Revenue Service for the taxable period.

STEP 4

WHERE TO FILE

Enter the amount of income received and expenses incurred by the QIC

The report and accompanying documents, if applicable, shall be mailed

in the taxable period. Attach supporting schedules as necessary.

to the NH Department of Revenue Administration, Audit Division, 109

Pleasant Street, PO Box 457, Concord, NH 03302-0457.

STEP 5

Check the box in Step 5 only if a copy of the federal return is being

PENALTY FOR FAILURE TO TIMELY FILE REPORT

submitted with this report.

Any QIC which fails to timely fi le the report as required by RSA 77-A:5-b,II

shall pay a penalty equal to $100 for each day such report is not fi led,

STEP 6

unless an extension has been granted by the Commissioner. In no event

Signature of the duly authorized representative (in ink) . Indicate the title

shall the monetary fi ne imposed exceed $5,000. A QIC notifi ed by the

of the representative and the date. If the report is prepared by someone

Department that such report is overdue by more than 50 days shall have

other than the duly authorized representative please sign, in ink, and give

30 days from the date of such notifi cation to fi le the delinquent report.

Federal Employer Identifi cation Number, address and the date.

If the delinquent report is not fi led within 30 days after notifi cation, the

Commissioner shall disallow the business organization's QIC status for

-OR-

any taxable period for which a timely report has not been fi led.

STEP 1

RECORD KEEPING

Enter the name, address and Federal Employer Identifi cation Number

All of the normal tax administration powers given to the Department with

or Department Identifi cation Number of the business organization

respect to other taxes and taxpayers are also applicable to QICs. In

submitting this report in the spaces provided.

accordance with the provisions of RSA 77-A:5-b, IV, QICs are subject to

the requirements of RSA 77-A:11 and RSA 77-E:10. Such organizations

STEP 2 - 4

must comply with the standard record keeping and availability of records

Attach a copy of federal income tax return as fi led with the Internal

for audit requirements that apply to other NH business taxpayers.

Revenue Service for the taxable period.

NEED HELP?

STEP 5

For more information concerning this report you may call the Audit

Indicate by checking the box that the federal return is being submitted

Division at (603) 271-3400.

with this report.

NEED FORMS?

STEP 6

To obtain the form needed to fi le this report visit our web site at

Signature of the duly authorized representative (in ink) . Indicate the title

, or call the forms line at (603) 271-2192.

of the representative and the date. If the report is prepared by someone

other than the duly authorized representative please sign, in ink, and give

Federal Employer Identifi cation Number, address and the date.

AU-208

Instructions

Rev 02/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1