Form St-101 - Sales And Use Tax On Motor Fuel And Diesel Motor Fuel - Annual Schedule For 2000

ADVERTISEMENT

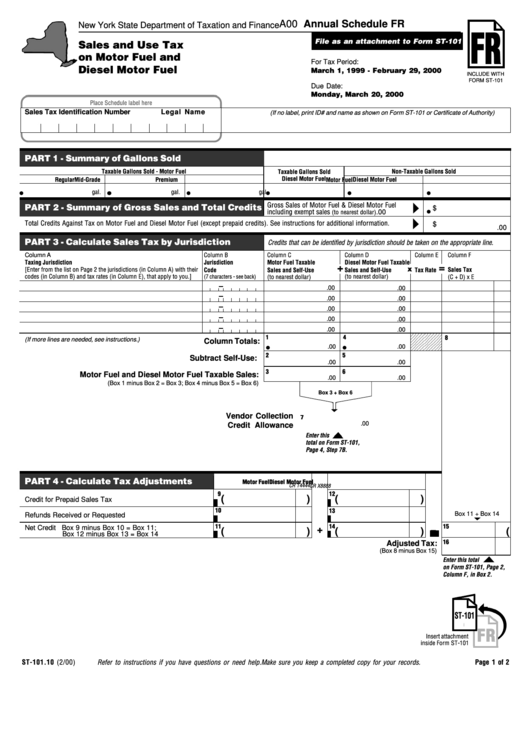

A00 Annual Schedule FR

New York State Department of Taxation and Finance

FR

File as an attachment to Form ST-101

Sales and Use Tax

on Motor Fuel and

For Tax Period:

Diesel Motor Fuel

March 1, 1999 - February 29, 2000

INCLUDE WITH

FORM ST-101

Due Date:

Monday, March 20, 2000

Place Schedule label here

Sales Tax Identification Number

Legal Name

(If no label, print ID# and name as shown on Form ST-101 or Certificate of Authority)

PART 1 - Summary of Gallons Sold

Taxable Gallons Sold - Motor Fuel

Taxable Gallons Sold

Non-Taxable Gallons Sold

Diesel Motor Fuel

Regular

Mid-Grade

Premium

Motor Fuel

Diesel Motor Fuel

gal.

gal.

gal.

gal.

gal.

gal.

Gross Sales of Motor Fuel & Diesel Motor Fuel

PART 2 - Summary of Gross Sales and Total Credits

$

including exempt sales

.00

(to nearest dollar)

Total Credits Against Tax on Motor Fuel and Diesel Motor Fuel (except prepaid credits). See instructions for additional information.

$

.00

PART 3 - Calculate Sales Tax by Jurisdiction

Credits that can be identified by jurisdiction should be taken on the appropriate line.

Column A

Column B

Column C

Column D

Column E

Column F

Taxing Jurisdiction

Jurisdiction

Motor Fuel Taxable

Diesel Motor Fuel Taxable

+

=

x

[Enter from the list on Page 2 the jurisdictions (in Column A) with their

Sales Tax

Code

Sales and Self-Use

Sales and Self-Use

Tax Rate

codes (in Column B) and tax rates (in Column E), that apply to you.]

(to nearest dollar)

(7 characters - see back)

(to nearest dollar)

(C + D) x E

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

1

4

8

(If more lines are needed, see instructions.)

1 2 3 4 5 6 7 8 9 0 1

Column Totals:

1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1

.00

.00

1 2 3 4 5 6 7 8 9 0 1

2

5

Subtract Self-Use:

.00

.00

3

6

Motor Fuel and Diesel Motor Fuel Taxable Sales:

.00

.00

(Box 1 minus Box 2 = Box 3; Box 4 minus Box 5 = Box 6)

Box 3 + Box 6

Vendor Collection

7

.00

Credit Allowance

Enter this

total on Form ST-101,

Page 4, Step 7B.

PART 4 - Calculate Tax Adjustments

Diesel Motor Fuel

Motor Fuel

CR T4444

CR X8888

9

12

(

)

(

)

Credit for Prepaid Sales Tax

10

13

Box 11 + Box 14

Refunds Received or Requested

14

15

11

Net Credit Box 9 minus Box 10 = Box 11;

+

=

(

)

(

)

(

)

Box 12 minus Box 13 = Box 14

16

Adjusted Tax:

(Box 8 minus Box 15)

Enter this total

on Form ST-101, Page 2,

Column F, in Box 2.

ST-101

FR

Insert attachment

inside Form ST-101

ST-101.10 (2/00)

Refer to instructions if you have questions or need help.

Make sure you keep a completed copy for your records.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2