Form Lps 2742 - Local Unit Denial Of Homestead Exemption

ADVERTISEMENT

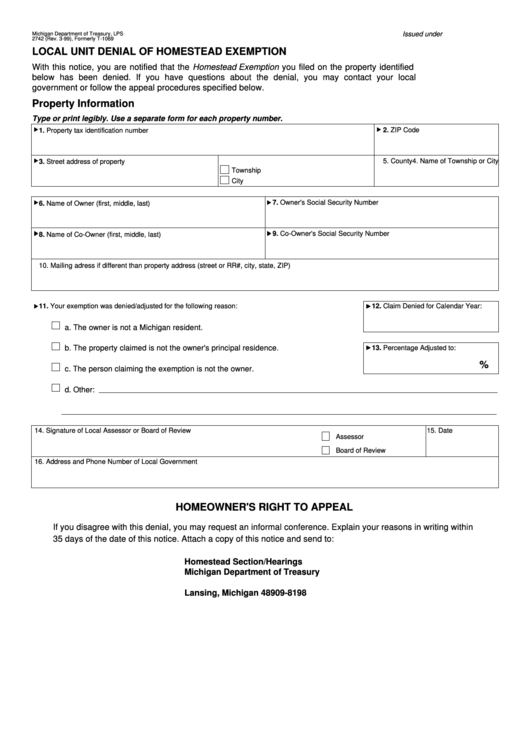

Michigan Department of Treasury, LPS

Issued under P.A. 237 of 1994.

2742 (Rev. 3-99), Formerly T-1069

LOCAL UNIT DENIAL OF HOMESTEAD EXEMPTION

With this notice, you are notified that the Homestead Exemption you filed on the property identified

below has been denied. If you have questions about the denial, you may contact your local

government or follow the appeal procedures specified below.

Property Information

Type or print legibly. Use a separate form for each property number.

2. ZIP Code

1. Property tax identification number

4. Name of Township or City

5. County

3. Street address of property

Township

City

7. Owner's Social Security Number

6. Name of Owner (first, middle, last)

9. Co-Owner's Social Security Number

8. Name of Co-Owner (first, middle, last)

10. Mailing adress if different than property address (street or RR#, city, state, ZIP)

11. Your exemption was denied/adjusted for the following reason:

12. Claim Denied for Calendar Year:

a. The owner is not a Michigan resident.

b. The property claimed is not the owner's principal residence.

13. Percentage Adjusted to:

%

c. The person claiming the exemption is not the owner.

d. Other:

14. Signature of Local Assessor or Board of Review

15. Date

Assessor

Board of Review

16. Address and Phone Number of Local Government

HOMEOWNER'S RIGHT TO APPEAL

If you disagree with this denial, you may request an informal conference. Explain your reasons in writing within

35 days of the date of this notice. Attach a copy of this notice and send to:

Homestead Section/Hearings

Michigan Department of Treasury

P.O. Box 30698

Lansing, Michigan 48909-8198

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1