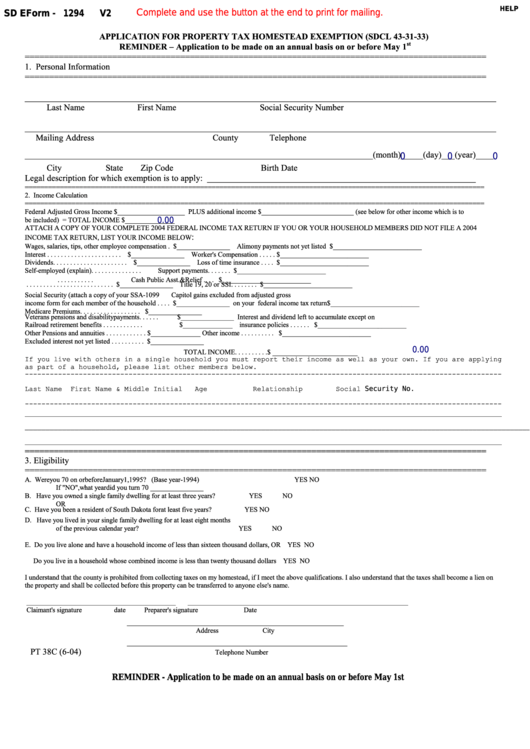

HELP

Complete and use the button at the end to print for mailing.

SD EForm -

1294

V2

APPLICATION FOR PROPERTY TAX HOMESTEAD EXEMPTION (SDCL 43-31-33)

st

REMINDER – Application to be made on an annual basis on or before May 1

===============================================================================================

1. Personal Information

===============================================================================================

___________________________________________________________________________________________________________

Last Name

First Name

Social Security Number

___________________________________________________________________________________________________________

Mailing Address

County

Telephone

0

0

0

_______________________________________________________________________________(month) _____ (day) ___ (year)____

City

State

Zip Code

Birth Date

Legal description for which exemption is to apply: _____________________________________________________________

======================================================================================================================

2. Income Calculation

======================================================================================================================

Federal Adjusted Gross Income $___________________ PLUS additional income $__________________________ (see below for other income which is to

be included) = TOTAL INCOME $______________

0.00

ATTACH A COPY OF YOUR COMPLETE 2004 FEDERAL INCOME TAX RETURN IF YOU OR YOUR HOUSEHOLD MEMBERS DID NOT FILE A 2004

:

INCOME TAX RETURN, LIST YOUR INCOME BELOW

Wages, salaries, tips, other employee compensation .

$_______________ Alimony payments not yet listed $_________________________

Interest . . . . . . . . . . . . . . . . . . . . . .

$_______________ Worker's Compensation . . . . .

$_________________________

Dividends. . . . . . . . . . . . . . . . . . . . . .

$_______________ Loss of time insurance . . . .

$_________________________

Self-employed (explain). . . . . . . . . . . . . . .

Support payments. . . . . . .

$_________________________

. . . . . . . . . . . . . . . . . . . . . . . . . .

Cash Public Asst. & Relief . . . . $_________________________

. . . . . . . . . . . . . . . . . . . . . . . . . .

$_______________ Title 19, 20 or SSI . . . . . . . .

$_________________________

Social Security (attach a copy of your SSA-1099

Capitol gains excluded from adjusted gross

income form for each member of the household . . . .

$_______________ on your federal income tax return$_________________________

Medicare Premiums. . . . . . . . . . . . . . . . . .

$_______________

Veterans pensions and disability payments. . . . . .

$_______________ Interest and dividend left to accumulate except on

Railroad retirement benefits . . . . . . . . . . . .

$______________

insurance policies . . . . . .

$_________________________

Other Pensions and annuities . . . . . . . . . . . .

$______________

Other income . . . . . . . . . .

$_________________________

Excluded interest not yet listed . . . . . . . . . .

$_______________

0.00

TOTAL INCOME. . . . . . . . . .

$ ________________________

If you live with others in a single household you must report their income as well as your own. If you are applying

as part of a household, please list other members below.

-------------------------------------------------------------------------------------------------------------------

Last Name

First Name & Middle Initial

Age

Relationship

Social Security No.

-------------------------------------------------------------------------------------------------------------------

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

===============================================================================================

3. Eligibility

===============================================================================================

A. Were you 70 on or before January 1, 1995? (Base year - 1994)

YES

NO

If "NO", what year did you turn 70 _______________

B. Have you owned a single family dwelling for at least three years?

YES

NO

OR

C. Have you been a resident of South Dakota for at least five years?

YES

NO

D. Have you lived in your single family dwelling for at least eight months

of the previous calendar year?

YES

NO

E. Do you live alone and have a household income of less than sixteen thousand dollars, OR

YES

NO

Do you live in a household whose combined income is less than twenty thousand dollars

YES

NO

I understand that the county is prohibited from collecting taxes on my homestead, if I meet the above qualifications. I also understand that the taxes shall become a lien on

the property and shall be collected before this property can be transferred to anyone else's name.

__________________________________________

______________________________________________________________

Claimant's signature

date

Preparer's signature

Date

_____________________________________________________________

Address

City

______________________________________________________________

PT 38C (6-04)

Telephone Number

REMINDER - Application to be made on an annual basis on or before May 1st

1

1 2

2