Form Tc-721 - Exemption Certificate (Sales, Use, Tourism, And Motor Vehicle Rental Tax)

ADVERTISEMENT

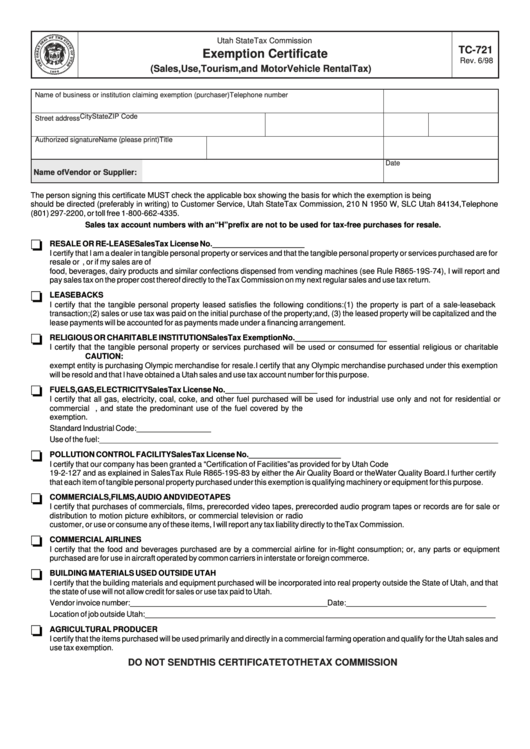

Utah State Tax Commission

TC-721

Exemption Certificate

Rev. 6/98

(Sales, Use, Tourism, and Motor Vehicle Rental Tax)

Name of business or institution claiming exemption (purchaser)

Telephone number

City

State

ZIP Code

Street address

Authorized signature

Name (please print)

Title

Date

Name of Vendor or Supplier:

The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed. Questions

should be directed (preferably in writing) to Customer Service, Utah State Tax Commission, 210 N 1950 W, SLC Utah 84134, Telephone

(801) 297-2200, or toll free 1-800-662-4335.

Sales tax account numbers with an “H” prefix are not to be used for tax-free purchases for resale.

RESALE OR RE-LEASE

SalesTax License No. _____________________

I certify that I am a dealer in tangible personal property or services and that the tangible personal property or services purchased are for

resale or re-lease. If I use or consume any tangible personal property or services that I purchase tax free for resale, or if my sales are of

food, beverages, dairy products and similar confections dispensed from vending machines (see Rule R865-19S-74), I will report and

pay sales tax on the proper cost thereof directly to the Tax Commission on my next regular sales and use tax return.

LEASEBACKS

I certify that the tangible personal property leased satisfies the following conditions: (1) the property is part of a sale-leaseback

transaction; (2) sales or use tax was paid on the initial purchase of the property; and, (3) the leased property will be capitalized and the

lease payments will be accounted for as payments made under a financing arrangement.

RELIGIOUS OR CHARITABLE INSTITUTION

SalesTax Exemption No. _____________________

I certify that the tangible personal property or services purchased will be used or consumed for essential religious or charitable

purposes.

CAUTION:

The normal charitable and religious exemption does not apply to purchases of Olympic merchandise unless the

exempt entity is purchasing Olympic merchandise for resale. I certify that any Olympic merchandise purchased under this exemption

will be resold and that I have obtained a Utah sales and use tax account number for this purpose.

FUELS, GAS, ELECTRICITY

SalesTax License No. _____________________

I certify that all gas, electricity, coal, coke, and other fuel purchased will be used for industrial use only and not for residential or

commercial purposes. Include the business Standard Industrial Code, and state the predominant use of the fuel covered by the

exemption.

Standard Industrial Code: _________________

Use of the fuel: ___________________________________________________________________________________________

POLLUTION CONTROL FACILITY

SalesTax License No. _____________________

I certify that our company has been granted a “Certification of Facilities” as provided for by Utah Code Ann. Sections 19-2-123 through

19-2-127 and as explained in Sales Tax Rule R865-19S-83 by either the Air Quality Board or the Water Quality Board. I further certify

that each item of tangible personal property purchased under this exemption is qualifying machinery or equipment for this purpose.

COMMERCIALS, FILMS, AUDIO ANDVIDEOTAPES

I certify that purchases of commercials, films, prerecorded video tapes, prerecorded audio program tapes or records are for sale or

distribution to motion picture exhibitors, or commercial television or radio broadcasters. If I subsequently resell items to any other

customer, or use or consume any of these items, I will report any tax liability directly to the Tax Commission.

COMMERCIAL AIRLINES

I certify that the food and beverages purchased are by a commercial airline for in-flight consumption; or, any parts or equipment

purchased are for use in aircraft operated by common carriers in interstate or foreign commerce.

BUILDING MATERIALS USED OUTSIDE UTAH

I certify that the building materials and equipment purchased will be incorporated into real property outside the State of Utah, and that

the state of use will not allow credit for sales or use tax paid to Utah.

Vendor invoice number: _____________________________________________ Date: ________________________________

Location of job outside Utah: ________________________________________________________________________________

AGRICULTURAL PRODUCER

I certify that the items purchased will be used primarily and directly in a commercial farming operation and qualify for the Utah sales and

use tax exemption.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

TC-721.CDR Rev. 6/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2