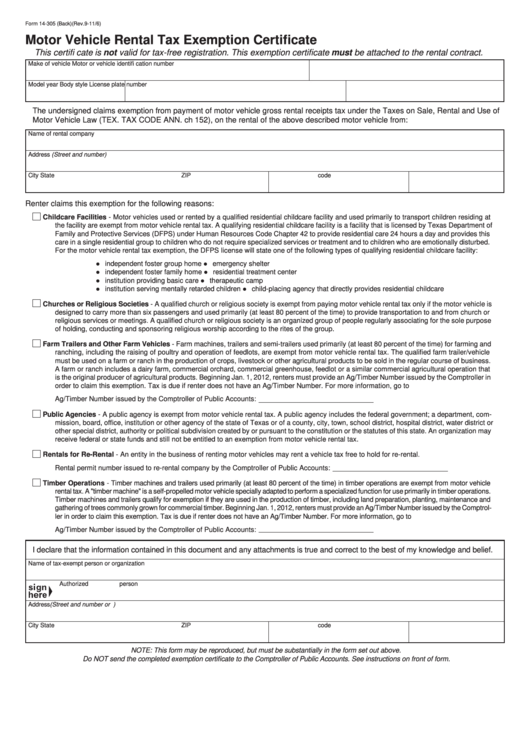

Form 14-305 (Back)(Rev.9-11/6)

Motor Vehicle Rental Tax Exemption Certificate

This certifi cate is not valid for tax-free registration. This exemption certificate must be attached to the rental contract.

Make of vehicle

Motor or vehicle identifi cation number

Model year

Body style

License plate number

The undersigned claims exemption from payment of motor vehicle gross rental receipts tax under the Taxes on Sale, Rental and Use of

Motor Vehicle Law (TEX. TAX CODE ANN. ch 152), on the rental of the above described motor vehicle from:

Name of rental company

Address (Street and number)

City

State

ZIP code

Renter claims this exemption for the following reasons:

Childcare Facilities - Motor vehicles used or rented by a qualified residential childcare facility and used primarily to transport children residing at

the facility are exempt from motor vehicle rental tax. A qualifying residential childcare facility is a facility that is licensed by Texas Department of

Family and Protective Services (DFPS) under Human Resources Code Chapter 42 to provide residential care 24 hours a day and provides this

care in a single residential group to children who do not require specialized services or treatment and to children who are emotionally disturbed.

For the motor vehicle rental tax exemption, the DFPS license will state one of the following types of qualifying residential childcare facility:

independent foster group home

emergency shelter

z

z

independent foster family home

residential treatment center

z

z

institution providing basic care

therapeutic camp

z

z

institution serving mentally retarded children

child-placing agency that directly provides residential childcare

z

z

Churches or Religious Societies - A qualified church or religious society is exempt from paying motor vehicle rental tax only if the motor vehicle is

designed to carry more than six passengers and used primarily (at least 80 percent of the time) to provide transportation to and from church or

religious services or meetings. A qualified church or religious society is an organized group of people regularly associating for the sole purpose

of holding, conducting and sponsoring religious worship according to the rites of the group.

Farm Trailers and Other Farm Vehicles - Farm machines, trailers and semi-trailers used primarily (at least 80 percent of the time) for farming and

ranching, including the raising of poultry and operation of feedlots, are exempt from motor vehicle rental tax. The qualified farm trailer/vehicle

must be used on a farm or ranch in the production of crops, livestock or other agricultural products to be sold in the regular course of business.

A farm or ranch includes a dairy farm, commercial orchard, commercial greenhouse, feedlot or a similar commercial agricultural operation that

is the original producer of agricultural products. Beginning Jan. 1, 2012, renters must provide an Ag/Timber Number issued by the Comptroller in

order to claim this exemption. Tax is due if renter does not have an Ag/Timber Number. For more information, go to

Ag/Timber Number issued by the Comptroller of Public Accounts:

Public Agencies - A public agency is exempt from motor vehicle rental tax. A public agency includes the federal government; a department, com-

mission, board, office, institution or other agency of the state of Texas or of a county, city, town, school district, hospital district, water district or

other special district, authority or political subdivision created by or pursuant to the constitution or the statutes of this state. An organization may

receive federal or state funds and still not be entitled to an exemption from motor vehicle rental tax.

Rentals for Re-Rental - An entity in the business of renting motor vehicles may rent a vehicle tax free to hold for re-rental.

Rental permit number issued to re-rental company by the Comptroller of Public Accounts:

Timber Operations - Timber machines and trailers used primarily (at least 80 percent of the time) in timber operations are exempt from motor vehicle

rental tax. A "timber machine" is a self-propelled motor vehicle specially adapted to perform a specialized function for use primarily in timber operations.

Timber machines and trailers qualify for exemption if they are used in the production of timber, including land preparation, planting, maintenance and

gathering of trees commonly grown for commercial timber. Beginning Jan. 1, 2012, renters must provide an Ag/Timber Number issued by the Comptrol-

ler in order to claim this exemption. Tax is due if renter does not have an Ag/Timber Number. For more information, go to

Ag/Timber Number issued by the Comptroller of Public Accounts:

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

Name of tax-exempt person or organization

Authorized person

Address (Street and number or P.O. Box number)

City

State

ZIP code

NOTE: This form may be reproduced, but must be substantially in the form set out above.

Do NOT send the completed exemption certificate to the Comptroller of Public Accounts. See instructions on front of form.

1

1 2

2