City Of Loveland Sales Tax Return Instructions Sheet

ADVERTISEMENT

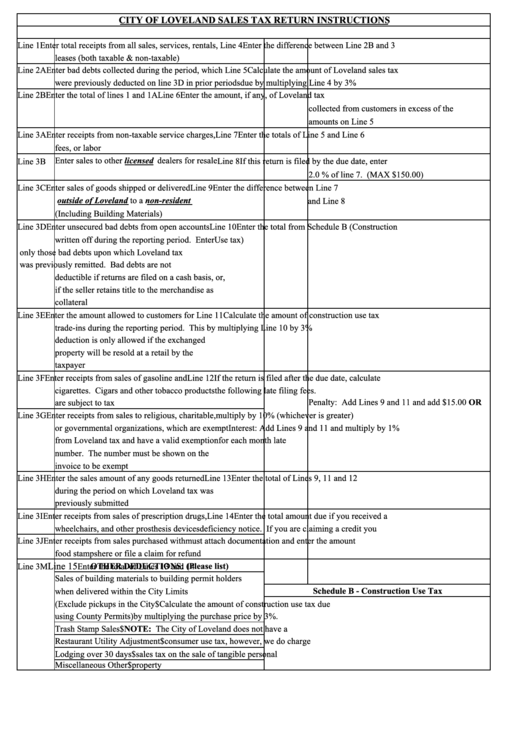

CITY OF LOVELAND SALES TAX RETURN INSTRUCTIONS

Line 1

Enter total receipts from all sales, services, rentals,

Line 4

Enter the difference between Line 2B and 3

leases (both taxable & non-taxable)

Line 2A

Enter bad debts collected during the period, which

Line 5

Calculate the amount of Loveland sales tax

were previously deducted on line 3D in prior periods

due by multiplying Line 4 by 3%

Line 2B

Enter the total of lines 1 and 1A

Line 6

Enter the amount, if any, of Loveland tax

collected from customers in excess of the

amounts on Line 5

Line 3A

Enter receipts from non-taxable service charges,

Line 7

Enter the totals of Line 5 and Line 6

fees, or labor

Enter sales to other licensed dealers for resale

Line 3B

Line 8

If this return is filed by the due date, enter

2.0 % of line 7. (MAX $150.00)

Line 3C

Enter sales of goods shipped or delivered

Line 9

Enter the difference between Line 7

outside of Loveland to a non-resident

and Line 8

(Including Building Materials)

Line 3D

Enter unsecured bad debts from open accounts

Line 10

Enter the total from Schedule B (Construction

written off during the reporting period. Enter

Use tax)

only those bad debts upon which Loveland tax

was previously remitted. Bad debts are not

deductible if returns are filed on a cash basis, or,

if the seller retains title to the merchandise as

collateral

Line 3E

Enter the amount allowed to customers for

Line 11

Calculate the amount of construction use tax

trade-ins during the reporting period. This

by multiplying Line 10 by 3%

deduction is only allowed if the exchanged

property will be resold at a retail by the

taxpayer

Line 3F

Enter receipts from sales of gasoline and

Line 12

If the return is filed after the due date, calculate

cigarettes. Cigars and other tobacco products

the following late filing fees.

Penalty: Add Lines 9 and 11 and add $15.00 OR

are subject to tax

Line 3G

Enter receipts from sales to religious, charitable,

multiply by 10% (whichever is greater)

or governmental organizations, which are exempt

Interest: Add Lines 9 and 11 and multiply by 1%

from Loveland tax and have a valid exemption

for each month late

number. The number must be shown on the

invoice to be exempt

Line 3H

Enter the sales amount of any goods returned

Line 13

Enter the total of Lines 9, 11 and 12

during the period on which Loveland tax was

previously submitted

Line 3I

Enter receipts from sales of prescription drugs,

Line 14

Enter the total amount due if you received a

wheelchairs, and other prosthesis devices

deficiency notice. If you are claiming a credit you

Line 3J

Enter receipts from sales purchased with

must attach documentation and enter the amount

food stamps

here or file a claim for refund

Line 15

Line 3M

OTHER DEDUCTIONS: (Please list)

Enter the total of Lines 13 and 14

Sales of building materials to building permit holders

when delivered within the City Limits

Schedule B - Construction Use Tax

(Exclude pickups in the City

$

Calculate the amount of construction use tax due

using County Permits)

by multiplying the purchase price by 3%.

Trash Stamp Sales

$

NOTE:

The City of Loveland does not have a

Restaurant Utility Adjustment

$

consumer use tax, however, we do charge

Lodging over 30 days

$

sales tax on the sale of tangible personal

Miscellaneous Other

$

property

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1