Transaction Privilege (Sales) Tax Return Instruction Sheet - 2004

ADVERTISEMENT

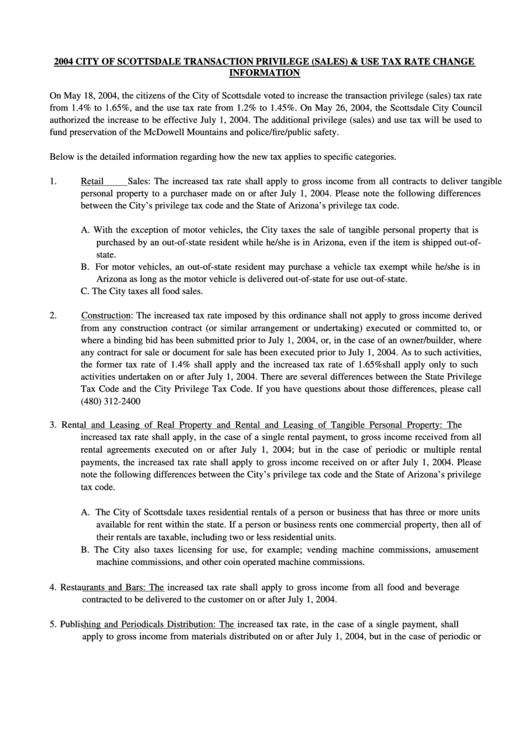

2004 CITY OF SCOTTSDALE TRANSACTION PRIVILEGE (SALES) & USE TAX RATE CHANGE

INFORMATION

On May 18, 2004, the citizens of the City of Scottsdale voted to increase the transaction privilege (sales) tax rate

from 1.4% to 1.65%, and the use tax rate from 1.2% to 1.45%. On May 26, 2004, the Scottsdale City Council

authorized the increase to be effective July 1, 2004. The additional privilege (sales) and use tax will be used to

fund preservation of the McDowell Mountains and police/fire/public safety.

Below is the detailed information regarding how the new tax applies to specific categories.

1.

Retail Sales: The increased tax rate shall apply to gross income from all contracts to deliver tangible

personal property to a purchaser made on or after July 1, 2004. Please note the following differences

between the City’s privilege tax code and the State of Arizona’s privilege tax code.

A. With the exception of motor vehicles, the City taxes the sale of tangible personal property that is

purchased by an out-of-state resident while he/she is in Arizona, even if the item is shipped out-of-

state.

B. For motor vehicles, an out-of-state resident may purchase a vehicle tax exempt while he/she is in

Arizona as long as the motor vehicle is delivered out-of-state for use out-of-state.

C. The City taxes all food sales.

2.

Construction: The increased tax rate imposed by this ordinance shall not apply to gross income derived

from any construction contract (or similar arrangement or undertaking) executed or committed to, or

where a binding bid has been submitted prior to July 1, 2004, or, in the case of an owner/builder, where

any contract for sale or document for sale has been executed prior to July 1, 2004. As to such activities,

the former tax rate of 1.4% shall apply and the increased tax rate of 1.65% shall apply only to such

activities undertaken on or after July 1, 2004. There are several differences between the State Privilege

Tax Code and the City Privilege Tax Code. If you have questions about those differences, please call

(480) 312-2400

3.

Rental and Leasing of Real Property and Rental and Leasing of Tangible Personal Property: The

increased tax rate shall apply, in the case of a single rental payment, to gross income received from all

rental agreements executed on or after July 1, 2004; but in the case of periodic or multiple rental

payments, the increased tax rate shall apply to gross income received on or after July 1, 2004. Please

note the following differences between the City’s privilege tax code and the State of Arizona’s privilege

tax code.

A. The City of Scottsdale taxes residential rentals of a person or business that has three or more units

available for rent within the state. If a person or business rents one commercial property, then all of

their rentals are taxable, including two or less residential units.

B. The City also taxes licensing for use, for example; vending machine commissions, amusement

machine commissions, and other coin operated machine commissions.

4.

Restaurants and Bars: The increased tax rate shall apply to gross income from all food and beverage

contracted to be delivered to the customer on or after July 1, 2004.

5.

Publishing and Periodicals Distribution: The increased tax rate, in the case of a single payment, shall

apply to gross income from materials distributed on or after July 1, 2004, but in the case of periodic or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4