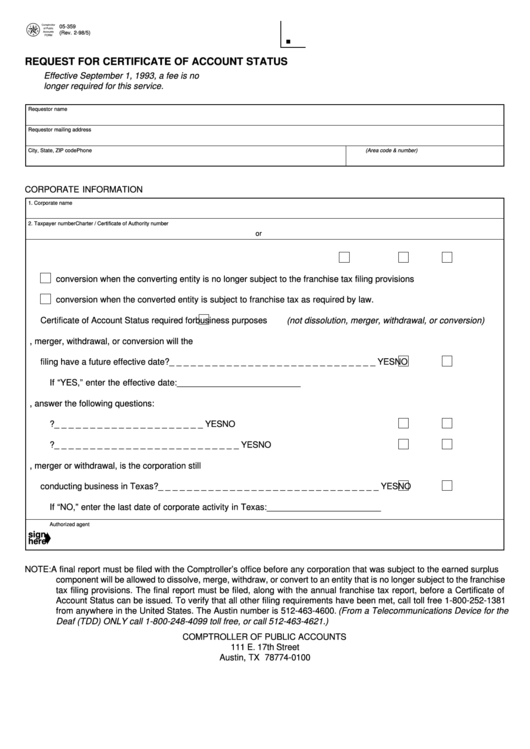

05-359

(Rev. 2-98/5)

REQUEST FOR CERTIFICATE OF ACCOUNT STATUS

Effective September 1, 1993, a fee is no

longer required for this service.

Requestor name

Requestor mailing address

City, State, ZIP code

Phone (Area code & number)

CORPORATE INFORMATION

1. Corporate name

2. Taxpayer number

Charter / Certificate of Authority number

or

3. Certificate of Account Status required for filing with the Secretary of State for

dissolution

merger

withdrawal

conversion when the converting entity is no longer subject to the franchise tax filing provisions

conversion when the converted entity is subject to franchise tax as required by law.

Certificate of Account Status required for

business purposes (not dissolution, merger, withdrawal, or conversion)

4. If the Certificate of Account Status is required for the purpose of dissolution, merger, withdrawal, or conversion will the

filing have a future effective date? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

If “YES,” enter the effective date: __________________________

5. If the Certificate of Account Status is required for the purpose of dissolution, answer the following questions:

A. Has the corporation commenced business? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

B. Has the corporation issued stock? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

6. If the Certificate of Account Status is required for the purpose of dissolution, merger or withdrawal, is the corporation still

conducting business in Texas? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

If “NO,” enter the last date of corporate activity in Texas: ________________________

Authorized agent

sign

here

NOTE: A final report must be filed with the Comptroller’s office before any corporation that was subject to the earned surplus

component will be allowed to dissolve, merge, withdraw, or convert to an entity that is no longer subject to the franchise

tax filing provisions. The final report must be filed, along with the annual franchise tax report, before a Certificate of

Account Status can be issued. To verify that all other filing requirements have been met, call toll free 1-800-252-1381

from anywhere in the United States. The Austin number is 512-463-4600. (From a Telecommunications Device for the

Deaf (TDD) ONLY call 1-800-248-4099 toll free, or call 512-463-4621.)

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, TX 78774-0100

1

1