Form Au-967 - Request For Certificate Of Compliance

ADVERTISEMENT

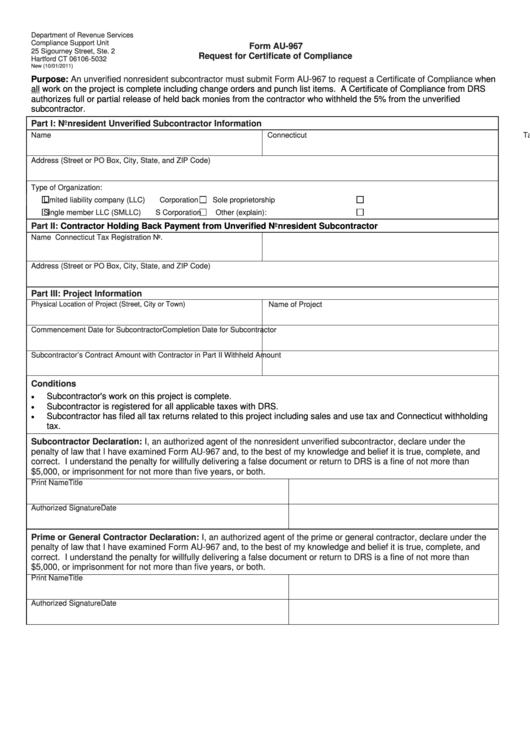

Department of Revenue Services

Compliance Support Unit

Form AU-967

25 Sigourney Street, Ste. 2

Request for Certificate of Compliance

Hartford CT 06106-5032

New (10/01/2011)

Purpose:

An unverified nonresident subcontractor must submit Form AU-967 to request a Certificate of Compliance

when

all work on the project is complete including change orders and punch list items. A Certificate of Compliance from DRS

authorizes full or partial release of held back monies from the contractor who withheld the 5% from the unverified

subcontractor.

Part I: Nonresident Unverified Subcontractor Information

Name

Connecticut Tax Registration No.

Address (Street or PO Box, City, State, and ZIP Code)

Type of Organization:

Limited liability company (LLC)

Corporation

Sole proprietorship

Single member LLC (SMLLC)

S Corporation

Other (explain):

Part II:

Contractor Holding Back Payment from Unverified Nonresident Subcontractor

Name

Connecticut Tax Registration No.

Address (Street or PO Box, City, State, and ZIP Code)

Part

III: Project Information

Physical Location of Project (Street, City or Town)

Name of Project

Commencement Date for Subcontractor

Completion Date for Subcontractor

Subcontractor’s Contract Amount with Contractor in Part II

Withheld Amount

Conditions

Subcontractor's work on this project is complete.

Subcontractor is registered for all applicable taxes with DRS.

Subcontractor has filed all tax returns related to this project including sales and use tax and Connecticut withholding

tax.

Subcontractor Declaration: I, an authorized agent of the nonresident unverified subcontractor, declare under the

penalty of law that I have examined Form AU-967 and, to the best of my knowledge and belief it is true, complete, and

correct. I understand the penalty for willfully delivering a false document or return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both.

Print Name

Title

Authorized Signature

Date

Prime or General Contractor Declaration: I, an authorized agent of the prime or general contractor, declare under the

penalty of law that I have examined Form AU-967 and, to the best of my knowledge and belief it is true, complete, and

correct. I understand the penalty for willfully delivering a false document or return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both.

Print Name

Title

Authorized Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1