The project must create a minimum of 20 jobs for new employees and the average hourly wage of all new employees at the project must not be less than

the base wage requirement. If the project is located in a Favored Geographic Area, minimum job creation is five (5) and the project is subject to a lower

base wage requirement.

Hydropower Electricity Production Project. A project owned by a utility described in Section 37-4-1(7)a, or owned by an investing company which

is itself owned by a utility, at which the predominant trade or business activity conducted will be the production of electricity from hydropower production

as defined in Section 40-18-1(16), with capital costs not less than $5,000,000. The project must create a minimum of 20 jobs for new employees and

the average hourly wage of all new employees at the project must not be less than the base wage requirement. If the project is located in a Favored Geo-

graphic Area, minimum job creation is five (5) and the project is subject to a lower base wage requirement.

Alabama State Docks Project. A project with capital costs which are not less than $8,000,000, and at which the predominant trade or business activ-

ity conducted will constitute industrial, warehousing, or research activity as defined in Section 40-18-240(4) as North American Industry Classification

System (NAICS) Subsector 493 (Warehousing and Storage), or Industry Number 488320 (Marine Cargo Handling), when the trade or business is con-

ducted on premises in which the Alabama State Port Authority has an ownership, leasehold, or other possessory interest and such premises are used

as part of the operations of the Alabama State Port Authority. The state docks project is provided under Section 40-18-240 et seq., Code of Alabama

1975.

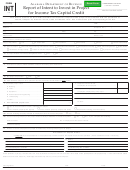

LINE BY LINE INSTRUCTIONS

Project Number – Enter the project number assigned by the Alabama

multiple stages (i.e., phases), identify all phases in the description.

Department of Revenue.

Attach additional sheets if necessary.

Project Entity – Enter the name of the entity that will receive the cap-

Line 4 – Enter the date project was placed in service. The credit

ital credit. The entity qualifying for the capital credit must be the entity

begins on the actual date the project is placed in service. Placed in ser-

meeting the requirements for the capital credit. If the qualifying project is

vice is defined as the earlier of the date on which either a) the period for

a joint venture, a legal project entity must be created in order for the

depreciation with respect to the project begins; or b) the project begins a

investing companies to receive the capital credit.

specifically designed function for the production of revenue. If the project

was completed in multiple stages (i.e., phases), enter the actual date the

Single Member Limited Liability Companies (“SMLLC”) will be classi-

last phase was placed in service. NOTE: If the project is a phased pro-

fied as they are classified for federal income tax purposes under the Inter-

ject, the capital credit will not begin until the last phase is placed in

nal Revenue Service’s (IRS) “check-the-box” regulations. If the investing

service and any tax liability incurred prior to the last phase being

company is a SMLLC that elects to be treated as a corporation for feder-

placed in service will not be subject to the credit.

al tax purposes, enter the SMLLC as the project entity. If the investing

company is a SMLLC that does not “check-the-box” for federal income tax

Line 5 – Enter the actual capital costs of the project. If the project is

purposes, the SMLLC shall be treated as a disregarded entity for Ala-

a phased project, enter the actual costs of all phases. To verify these

bama tax purposes and the parent must be entered as the project entity.

costs, the asset depreciation schedule is required to be attached to the

Form INT-2. The schedule should include the description, in-service date

Qualified Subchapter S Subsidiaries (Q-subs) under 26 U.S.C. Sec-

and cost of each asset. See Section 40-18-190(2), Departmental Rule

tion 1361(b)(3) shall be treated as disregarded entities for Alabama

810-2-7-.01(2)(c), or Section 40-18-240(1) for specific inclusions and

income tax purposes. If the investing company is a Q-sub, the parent

exclusions of capital costs.

must be entered as the project entity.

Line 6a – Add 5a through 5j and enter total here. The qualifying pro-

Project Name – Enter name of project if identified as a division or pro-

ject must meet the minimum capital investment for the type of project indi-

ject name. Enter company Doing Business As (DBA) if project is doing

cated.

business under another name. Enter the name of the SMLLC if the qual-

ifying project is a SMLLC treated as a disregarded entity for tax purpos-

Line 6b – Multiply line 6a by 5%. This is the maximum amount of cap-

es. Enter the name of the Q-sub if the qualifying project is a Q-sub.

ital credit available to be applied against the income tax or financial insti-

tution excise tax liability generated by or arising out of the qualifying pro-

Address – Enter the address to which all correspondence should be

ject each year for 20 years, beginning in the year the project is placed in

directed regarding the project.

service.

Location of Project – Enter the project’s physical address.

Line 7 – Enter the number of new employees hired at this project. The

FEIN – Enter the Federal Employer Identification Number.

qualifying project must meet the minimum job requirement for the type of

project indicated. New employees are those persons who have not pre-

NAICS Code – If the predominant business activity is an industrial,

viously been employed at the site on which the project is or will be placed

warehousing or research activity as defined in Code of Alabama 1975

in service or have not been employed by the investing company or com-

Section 40-18-190(a)(8), a warehousing or storage activity, a headquar-

panies in this state; will be employed full-time as a direct result of the pro-

ters facility , or a state docks project as defined in Section 40-18-240(4),

ject being placed in service; and will be subject to the personal income

enter the 2007 North American Industrial Classification System (NAICS)

tax imposed by Section 40-18-2, Code of Alabama 1975, upon com-

code for the project.

mencement of employment at the project. Jobs must be provided begin-

Project Filing Status – Check the applicable box.

ning with the date which is not later than one (1) year after the project is

placed in service and continuing each year thereafter. For warehousing or

Line 1a – Check the applicable box. See “Statutory Requirements for

storage activity projects, jobs must be provided beginning with the date

Qualifying Projects” for project descriptions.

which is not later than two (2) years after the project is placed in service

Line 1b – Indicate if project is located in a Favored Geographic Area

and continuing each year thereafter.

(FGA). This designation is determined at the time the Form INT is filed for

the project.

A project that qualifies in a FGA will continue to be a qual-

Line 8 – Enter the average hourly wage of the new employees of the

ified FGA project, even if the county later loses its designation as a FGA

project. Section 40-18-193(a) requires the average hourly wages for all

as long as the project otherwise remains in compliance with the law.

new employees at the qualifying project be not less than the base wage

requirement no later than one year after the project is placed in service

Line 2 – Briefly describe the type of trade or business that the project

and during each year the capital credit is available. For projects whose

is engaged in. For projects that do not require a NAICS code, provide a

Form INT was filed after May 22, 2009, the base wage requirement is the

detailed description that will identify the activities as qualifying activities.

lesser of the indexed hourly wage or the average hourly wage of the

Attach additional sheets if necessary.

county where the project is located, excluding benefits. For these pro-

Line 3 – Enter a full description of the activities of the project. Please

jects, the base wage requirement is determined as of the date the Form

be detailed in the activities of the project. If the project was completed in

INT for the project was filed with the Department and will remain constant

1

1 2

2 3

3 4

4