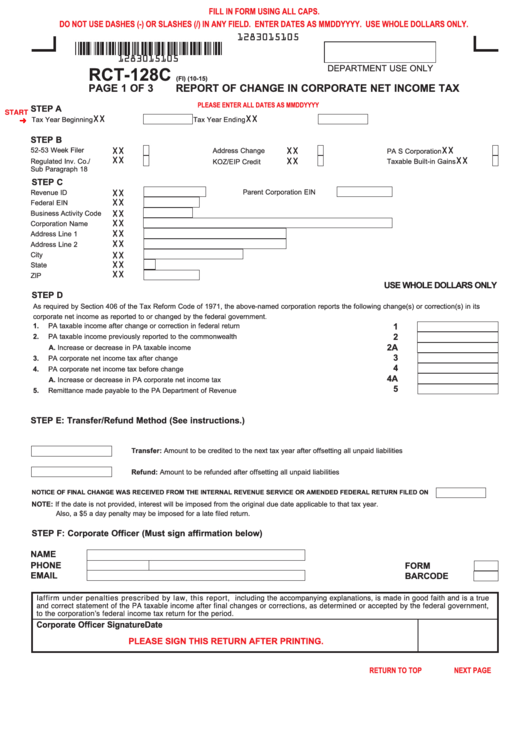

FILL IN FORM USING ALL CAPS.

DO NOT USE DASHES (-) OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

1283015105

1283015105

DEPARTMENT USE ONLY

RCT-128C

(FI) (10-15)

PAGE 1 OF 3

REPORT OF CHANGE IN CORPORATE NET INCOME TAX

PLEASE ENTER ALL DATES AS MMDDYYYY

STEP A

START

XX

XX

Tax Year Beginning

Tax Year Ending

STEP B

XX

XX

XX

52-53 Week Filer

Address Change

PA S Corporation

XX

XX

XX

Regulated Inv. Co./

Taxable Built-in Gains

KOZ/EIP Credit

Sub Paragraph 18

STEP C

XX

Parent Corporation EIN

Revenue ID

XX

Federal EIN

XX

Business Activity Code

XX

Corporation Name

XX

Address Line 1

XX

Address Line 2

XX

City

XX

State

XX

ZIP

USE WHOLE DOLLARS ONLY

STEP D

As required by Section 406 of the Tax Reform Code of 1971, the above-named corporation reports the following change(s) or correction(s) in its

corporate net income as reported to or changed by the federal government.

1.

PA taxable income after change or correction in federal return

1

2

2.

PA taxable income previously reported to the commonwealth

2A

A. Increase or decrease in PA taxable income

3

3.

PA corporate net income tax after change

4

4.

PA corporate net income tax before change

4A

A. Increase or decrease in PA corporate net income tax

5

5.

Remittance made payable to the PA Department of Revenue

STEP E: Transfer/Refund Method (See instructions.)

Transfer: Amount to be credited to the next tax year after offsetting all unpaid liabilities

Refund: Amount to be refunded after offsetting all unpaid liabilities

NOTICE OF FINAL CHANGE WAS RECEIVED FROM THE INTERNAL REVENUE SERVICE OR AMENDED FEDERAL RETURN FILED ON

NOTE: If the date is not provided, interest will be imposed from the original due date applicable to that tax year.

Also, a $5 a day penalty may be imposed for a late filed return.

STEP F: Corporate Officer (Must sign affirmation below)

NAME

PHONE

FORM

EMAIL

BARCODE

I affirm under penalties prescribed by law, this report, including the accompanying explanations, is made in good faith and is a true

and correct statement of the PA taxable income after final changes or corrections, as determined or accepted by the federal government,

to the corporation’s federal income tax return for the period.

Corporate Officer Signature

Date

PLEASE SIGN THIS RETURN AFTER PRINTING.

PRINT FORM

Reset Entire Form

RETURN TO TOP

NEXT PAGE

1

1 2

2 3

3