Form Ir - Personal Income Tax Return - 2005

ADVERTISEMENT

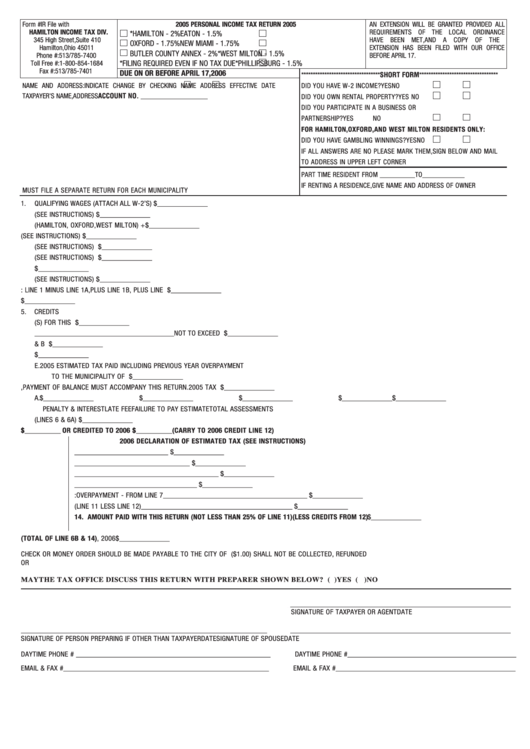

Form #IR File with

2005 PERSONAL INCOME TAX RETURN 2005

AN EXTENSION WILL BE GRANTED PROVIDED ALL

HAMILTON INCOME TAX DIV.

REQUIREMENTS OF THE LOCAL ORDINANCE

*HAMILTON - 2%

EATON - 1.5%

345 High Street, Suite 410

HAVE BEEN MET, AND A COPY OF THE

OXFORD - 1.75%

NEW MIAMI - 1.75%

Hamilton, Ohio 45011

EXTENSION HAS BEEN FILED WITH OUR OFFICE

BUTLER COUNTY ANNEX - 2%

*WEST MILTON - 1.5%

Phone #: 513/785-7400

BEFORE APRIL 17.

Toll Free #: 1-800-854-1684

*FILING REQUIRED EVEN IF NO TAX DUE

*PHILLIPSBURG - 1.5%

Fax #: 513/785-7401

DUE ON OR BEFORE APRIL 17, 2006

**********************************SHORT FORM**********************************

NAME AND ADDRESS: INDICATE CHANGE BY CHECKING

NAME

ADDRESS EFFECTIVE DATE

DID YOU HAVE W-2 INCOME?

YES

NO

TAXPAYER’S NAME, ADDRESS

ACCOUNT NO. ___________________

DID YOU OWN RENTAL PROPERTY?

YES

NO

DID YOU PARTICIPATE IN A BUSINESS OR

PARTNERSHIP?

YES

NO

FOR HAMILTON, OXFORD, AND WEST MILTON RESIDENTS ONLY:

DID YOU HAVE GAMBLING WINNINGS?

YES

NO

IF ALL ANSWERS ARE NO PLEASE MARK THEM, SIGN BELOW AND MAIL

TO ADDRESS IN UPPER LEFT CORNER

PART TIME RESIDENT FROM __________TO____________

IF RENTING A RESIDENCE, GIVE NAME AND ADDRESS OF OWNER

MUST FILE A SEPARATE RETURN FOR EACH MUNICIPALITY

1.

QUALIFYING WAGES (ATTACH ALL W-2’S) .......................................................................................................................................................... $______________

A. REDUCTION OF INCOME (SEE INSTRUCTIONS) ......................................................................................................................................... - $______________

B. GAMBLING WINNINGS (HAMILTON, OXFORD, WEST MILTON) .................................................................................................................... + $______________

2.

OTHER TAXABLE INCOME (SEE INSTRUCTIONS) .................................................................................................................... $______________

A. NET OPERATING LOSSES - CURRENT YEAR (SEE INSTRUCTIONS) ................................................... $______________

B. LOSS PER PREVIOUS INCOME TAX RETURNS (SEE INSTRUCTIONS) ................................................. $______________

C. TOTAL OF LINE 2A AND 2B ............................................................................................................................................ $______________

D. LINE 2 MINUS 2C (SEE INSTRUCTIONS) ....................................................................................................................................................... $______________

3.

TAXABLE INCOME: LINE 1 MINUS LINE 1A, PLUS LINE 1B, PLUS LINE 2D ........................................................................................................... $______________

4.

MUNICIPAL TAX

OF AMOUNT ON LINE 3...................................................................................................................... $______________

5.

CREDITS

A. TAX WITHHELD BY EMPLOYER(S) FOR THIS MUNICIPALITY ............................................................................................... $______________

B. TAX PAID MUNICIPALITY OF______________________________________NOT TO EXCEED ............................................ $______________

C. TOTAL OF LINES 5A & B ................................................................................................................................................ $______________

D. LINE 4 MINUS 5C ..............................................................................................................................................................NET TAX DUE

$______________

E. 2005 ESTIMATED TAX PAID INCLUDING PREVIOUS YEAR OVERPAYMENT

TO THE MUNICIPALITY OF ...................................................................................................................................................................... $______________

6.

IF LINE 5D IS GREATER THAN LINE 5E, PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN. 2005 TAX DUE ............................................... $______________

A. $______________

$______________

$______________

$______________

$______________

PENALTY & INTEREST

LATE FEE

FAILURE TO PAY ESTIMATE

TOTAL ASSESSMENTS

B. TOTAL TAX AND ASSESSMENTS DUE (LINES 6 & 6A)..................................................................................................................................... $______________

7.

IF LINE 5E IS GREATER THAN 5D OVERPAYMENT TO BE REFUNDED $__________ OR CREDITED TO 2006 $__________(CARRY TO 2006 CREDIT LINE 12)

2006 DECLARATION OF ESTIMATED TAX (SEE INSTRUCTIONS)

8. ESTIMATED INCOME SUBJECT TO

TAX __________________________ $______________

9.

OF AMOUNT SHOWN ON LINE 8 ________________________________ $______________

10. LESS TAX TO BE WITHHELD FOR CITY OF ________________________________________ $______________

11. BALANCE OF TAX DECLARED FOR ENTIRE YEAR __________________________________ $______________

12. CREDITS: OVERPAYMENT - FROM LINE 7 ________________________________________ $______________

13. NET TAX DUE (LINE 11 LESS LINE 12) __________________________________________ $______________

14. AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 25% OF LINE 11)(LESS CREDITS FROM 12) ......................................... $______________

15. TOTAL AMOUNT DUE (TOTAL OF LINE 6B & 14) .....................................................................................................DUE BY APRIL 17, 2006

$______________

CHECK OR MONEY ORDER SHOULD BE MADE PAYABLE TO THE CITY OF HAMILTON. AMOUNTS OF LESS THAN ONE DOLLAR ($1.00) SHALL NOT BE COLLECTED, REFUNDED

OR CREDITED. PAY TAXES TIMELY TO AVOID PENALTY AND/OR INTEREST. SEE THE BOTTOM OF PAGE TWO TO PAY BY CREDIT CARD.

MAY THE TAX OFFICE DISCUSS THIS RETURN WITH PREPARER SHOWN BELOW? ( )YES ( )NO

SIGNATURE OF TAXPAYER OR AGENT

DATE

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF SPOUSE

DATE

DAYTIME PHONE # _____________________________________________________

DAYTIME PHONE # ______________________________________________

EMAIL & FAX # ________________________________________________________

EMAIL & FAX #_________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2