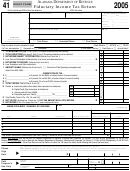

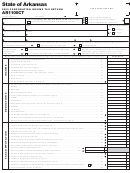

Form Ir - Personal Income Tax Return - 2005 Page 2

ADVERTISEMENT

PAGE 2

COMPLETE ITEMS IN SECTIONS A-C IF YOU HAVE OTHER TAXABLE INCOME.

SECTION A

PROFIT FROM ANY BUSINESS OWNED (ATTACH COPY OF FEDERAL SCHEDULE C) ...................................................................................................... $______________

DO YOU USE SUBCONTRACT LABOR TO PERFORM WORK IN THIS MUNICIPALITY?

YES

NO

IF YES, COPIES OF 1099’s ISSUED MUST BE SUBMITTED TO THIS

OFFICE WITHIN 4 MONTHS AFTER THE END OF THE TAX YEAR.

DO YOU HAVE EMPLOYEES WORKING IN THIS MUNICIPALITY?

YES

NO

IF YES, COPIES OF EMPLOYEES W-2 FORM MUST BE SUBMITTED BY FEBRUARY 28

TH.

SECTION B

SCHEDULE E - INCOME FROM RENTS...ATTACHED FEDERAL SCHEDULE E...PAGE 1 AND 2

NUMBER OF

DEPRECIATION

OTHER

KIND & LOCATION OF

AMOUNT OF

AMOUNT OF

REPAIRS

NET INCOME

MONTHS

(Attach

EXPENSES

PROPERTY

MONTHLY RENTAL

RENT

(Attach List)

OR LOSS

RENTED IN 2005

Schedules)

(Attach List)

NET INCOME (OR LOSS) SCHEDULE E ____________________ $______________

IF RENTAL WAS SOLD, PLEASE PROVIDE THE SALE DATE & LOCATION__________________________________________________________

SECTION C

OTHER TAXABLE INCOME (ATTACH APPROPRIATE FEDERAL SCHEDULE SUCH AS SCHEDULE F, 4797, 6252, ETC) ______________________________ $______________

TOTAL OTHER TAXABLE INCOME (SECTIONS A THRU C) INSERT ON LINE 2, PAGE 1 ______________________________________________________ $______________

TOTAL NET OPERATING LOSSES (SECTIONS A THRU C) INSERT ON LINE 2A, PAGE 1 _____________________________________________________ $______________

SEE INSTRUCTIONS ON SEPARATE PAGE

FOR COMPLETION OF LINES 1 THRU 15

NOTE: UNLESS ACCOMPANIED BY COPIES OF APPROPRIATE FEDERAL SCHEDULES AND PAYMENT OF THE BALANCE OF THE 2005 TAX DECLARED DUE (LINE 15) THIS FORM IS

NOT A LEGAL FINAL RETURN.

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN CHANGED THIS YEAR AS A RESULT OF AN EXAMINATION BY THE INTERNAL REVENUE SERVICE?

YES

NO.

IF YES, HAS AN AMENDED RETURN BEEN FILED FOR SUCH YEAR OR YEARS?

YES

NO. DID YOU RECEIVE OR APPLY FOR A REFUND FROM ANY OTHER MUNICIPALITY IN

2005?

YES

NO. IF SO, GIVE NAME OF MUNICIPALITY___________________ AMOUNT OF REFUND_________________ YEAR REFUND WAS FOR_________________.

TELEPHONE #___________________________________________________________________________

EMPLOYER IN 2005 ______________________________________________________________________

PRESENT EMPLOYER _____________________________________________________________________

DID YOU FILE A RETURN FOR 2004?

YES

NO

NOTE: IF RETURN IS NOT DUE CHECK BOX

AND ATTACH WRITTEN EXPLANATION. LATE FILING OF THIS RETURN SUBJECTS

HAMILTON TAXPAYERS TO A MINIMUM PENALTY OF $25.00.

NOTE: PAGE 2 MUST BE COMPLETED IF YOU HAVE TAXABLE RENTAL PROPERTY OR BUSINESS INCOME. IN LIEU OF COMPLETING

PAGE 2, YOU CAN ATTACH THE APPROPRIATE FEDERAL SCHEDULES.

A REQUEST FOR EXTENSION MUST BE FILED PRIOR TO APRIL 17. AN EXTENSION IS TO PROVIDE ADDITIONAL TIME TO FILE.

PAYMENTS ARE NOT EXTENDED.

NOTICE: BY LAW, ALL REFUNDS AND CREDITS IN EXCESS OF $10.00 ARE REPORTED TO IRS. I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING

SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAY-

ER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

NEW: PAY YOUR TAX BILL ONLINE @ and click on “Pay your bill online” or pay by credit card (see below).

Check one: Visa __________ or Mastercard __________

(16 digits) # _________ - _________ - _________ - _________ Card Expiration Date _________/ _________

Total Amount Authorized $ _________________________________

For 2005 $______________ For 2006 Estimate $ _______________

Signature ______________________________________________

Daytime Phone Number ___________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2