Loveland Income Tax Return Form-2005-2006

ADVERTISEMENT

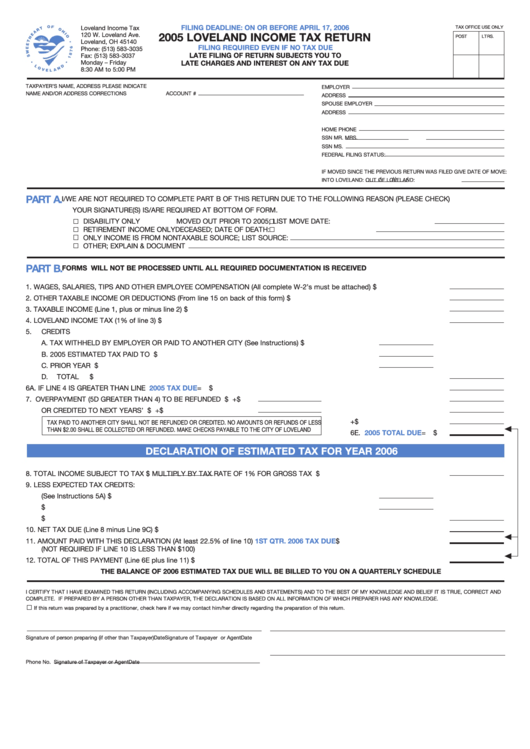

FILING DEADLINE: ON OR BEFORE APRIL 17, 2006

TAX OFFICE USE ONLY

Loveland Income Tax

120 W. Loveland Ave.

2005 LOVELAND INCOME TAX RETURN

POST

LTRS.

Loveland, OH 45140

FILING REQUIRED EVEN IF NO TAX DUE

Phone: (513) 583-3035

Fax: (513) 583-3037

LATE FILING OF RETURN SUBJECTS YOU TO

MAINT.

REF. AUD.

Monday – Friday

LATE CHARGES AND INTEREST ON ANY TAX DUE

8:30 AM to 5:00 PM

TAXPAYER’S NAME, ADDRESS PLEASE INDICATE

EMPLOYER

NAME AND/OR ADDRESS CORRECTIONS

ACCOUNT #

ADDRESS

SPOUSE EMPLOYER

ADDRESS

HOME PHONE

SSN MR.

MRS.

SSN MS.

FEDERAL FILING STATUS:

IF MOVED SINCE THE PREVIOUS RETURN WAS FILED GIVE DATE OF MOVE:

/

/

/

/

INTO LOVELAND:

OUT OF LOVELAND:

PART A.

I/WE ARE NOT REQUIRED TO COMPLETE PART B OF THIS RETURN DUE TO THE FOLLOWING REASON (PLEASE CHECK)

YOUR SIGNATURE(S) IS/ARE REQUIRED AT BOTTOM OF FORM.

DISABILITY ONLY

MOVED OUT PRIOR TO 2005; LIST MOVE DATE:

RETIREMENT INCOME ONLY

DECEASED; DATE OF DEATH:

ONLY INCOME IS FROM NONTAXABLE SOURCE; LIST SOURCE:

OTHER; EXPLAIN & DOCUMENT

PART B.

FORMS WILL NOT BE PROCESSED UNTIL ALL REQUIRED DOCUMENTATION IS RECEIVED

1.

WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (All complete W-2’s must be attached)...............................

$

2.

OTHER TAXABLE INCOME OR DEDUCTIONS (From line 15 on back of this form) ............................................................................

$

3.

TAXABLE INCOME (Line 1, plus or minus line 2)...................................................................................................................................

$

4.

LOVELAND INCOME TAX (1% of line 3) ................................................................................................................................................

$

5.

CREDITS

A.

TAX WITHHELD BY EMPLOYER OR PAID TO ANOTHER CITY (See Instructions) .................................. $

B.

2005 ESTIMATED TAX PAID TO LOVELAND.............................................................................................. $

C.

PRIOR YEAR OVERPAYMENTS ................................................................................................................. $

D.

TOTAL CREDITS ...........................................................................................................................................................................

$

6A. IF LINE 4 IS GREATER THAN LINE 5D....................................................................................................................

2005 TAX DUE

=

$

7.

OVERPAYMENT (5D GREATER THAN 4) TO BE REFUNDED .............$

6B. ADD INTEREST

+

$

OR CREDITED TO NEXT YEARS’ ESTIMATE.......................................$

6C. ADD PENALTY

+

$

6D. ADD LATE CHARGE +

$

TAX PAID TO ANOTHER CITY SHALL NOT BE REFUNDED OR CREDITED. NO AMOUNTS OR REFUNDS OF LESS

THAN $2.00 SHALL BE COLLECTED OR REFUNDED. MAKE CHECKS PAYABLE TO THE CITY OF LOVELAND

6E.

2005 TOTAL DUE

=

$

DECLARATION OF ESTIMATED TAX FOR YEAR 2006

8.

TOTAL INCOME SUBJECT TO TAX $

MULTIPLY BY TAX RATE OF 1% FOR GROSS TAX OF ...........................

$

9.

LESS EXPECTED TAX CREDITS:

A.

WITHHELD BY AN EMPLOYER OR PAID TO ANOTHER CITY (See Instructions 5A) .............................. $

B.

OVERPAYMENT FROM PRIOR YEAR ........................................................................................................ $

C.

TOTAL CREDITS.............................................................................................................................................................................

$

10. NET TAX DUE (Line 8 minus Line 9C) ....................................................................................................................................................

$

11. AMOUNT PAID WITH THIS DECLARATION (At least 22.5% of line 10)

.....................................................1ST QTR. 2006 TAX DUE

$

(NOT REQUIRED IF LINE 10 IS LESS THAN $100)

12. TOTAL OF THIS PAYMENT (Line 6E plus line 11)..................................................................................................................................

$

THE BALANCE OF 2006 ESTIMATED TAX DUE WILL BE BILLED TO Y0U ON A QUARTERLY SCHEDULE

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND

COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

If this return was prepared by a practitioner, check here if we may contact him/her directly regarding the preparation of this return.

Signature of person preparing (if other than Taxpayer)

Date

Signature of Taxpayer or Agent

Date

Phone No.

Signature of Taxpayer or Agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2