Form Pk-3 - Employer'S Registration Report For Newark Payroll Tax - 2007

ADVERTISEMENT

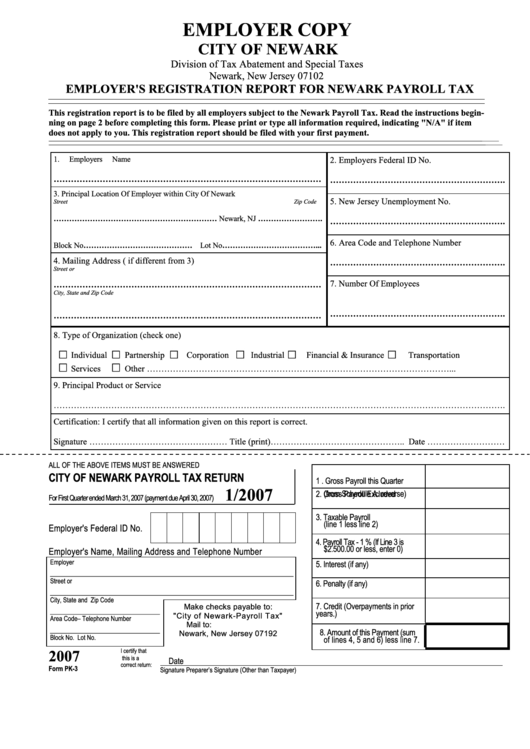

EMPLOYER COPY

CITY OF NEWARK

Division of Tax Abatement and Special Taxes

Newark, New Jersey 07102

EMPLOYER'S REGISTRATION REPORT FOR NEWARK PAYROLL TAX

This registration report is to be filed by all employers subject to the Newark Payroll Tax. Read the instructions begin-

ning on page 2 before completing this form. Please print or type all information required, indicating "N/A" if item

does not apply to you. This registration report should be filed with your first payment.

__________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

1.

Employers Name

2. Employers Federal ID No.

…………………………………………………………………………………

…………………………………………………….

3. Principal Location Of Employer within City Of Newark

5. New Jersey Unemployment No.

Street

Zip Code

……………………………………………………… Newark, NJ …………………….

…………………………………………………….

6. Area Code and Telephone Number

Block No…………………………………… Lot No………………………………...

4. Mailing Address ( if different from 3)

…………………………………………………….

Street or P.O. Box

7. Number Of Employees

…………………………………………………………………………………

City, State and Zip Code

…………………………………………………….

…………………………………………………………………………………

8. Type of Organization (check one)

Individual

Partnership

Corporation

Industrial

Financial & Insurance

Transportation

Services

Other ……………………………………………………………………………………………...

9. Principal Product or Service

………………………………………………………………………………………………………………………………………….

Certification: I certify that all information given on this report is correct.

Signature ………………………………………… Title (print)……………………………………….. Date ………………………

ALL OF THE ABOVE ITEMS MUST BE ANSWERED

CITY OF NEWARK PAYROLL TAX RETURN

1 . Gross Payroll this Quarter

1/2007

2. Gross Payroll Excluded

For First Quarter ended March 31, 2007 (payment due April 30, 2007)

(from Schedule A. reverse)

3. Taxable Payroll

(line 1 less line 2)

Employer's Federal ID No.

4. Payroll Tax - 1 % (If Line 3 is

$2.500.00 or less, enter 0)

Employer's Name, Mailing Address and Telephone Number

Employer

5. Interest (if any)

___________________________________________________

Street or P.O. Box

6. Penalty (if any)

___________________________________________________

City, State and Zip Code

7. Credit (Overpayments in prior

Make checks payable to:

_______________________

years.)

"City of Newark-Payroll Tax"

Area Code– Telephone Number

Mail to: P.O. Box 15118

_______________________

8. Amount of this Payment (sum

Newark, New Jersey 07192

Block No.

Lot No.

of lines 4, 5 and 6) less line 7.

2007

I certify that

this is a

Date

correct return:

Form PK-3

Signature

Preparer’s Signature (Other than Taxpayer)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4