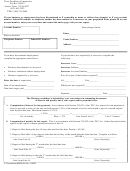

Form Pk-3 - Employer'S Registration Report For Newark Payroll Tax - 2007 Page 3

ADVERTISEMENT

ALL OF THE ABOVE ITEMS MUST BE ANSWERED

CITY OF NEWARK PAYROLL TAX RETURN

1 . Gross Payroll this Quarter

2/2007

2. Gross Payroll Excluded

For Second Quarter ended June 30, 2007 (payment due July 31, 2007)

(from Schedule A. reverse)

3. Taxable Payroll

(line 1 less line 2)

Employer's Federal ID No.

4. Payroll Tax - 1 % (If Line 3 is

Employer's Name, Mailing Address and Telephone Number

$2.500.00 or less, enter 0)

Employer

5. Interest (if any)

___________________________________________________

Street or P.O. Box

___________________________________________________

6. Penalty (if any)

City, State and Zip Code

Make checks payable to:

7. Credit (Overpayments in prior

_______________________

years.)

"City of Newark-Payroll Tax"

Area Code– Telephone Number

Mail to: P.O. Box 15118

_______________________

8. Amount of this Payment (sum

Newark, New Jersey 07192

Block No.

Lot No.

of lines 4, 5 and 6) less line 7.

2007

I certify that

this is a

Date

correct return:

Form PK-3

Signature

Preparer’s Signature (Other than Taxpayer)

ALL OF THE ABOVE ITEMS MUST BE ANSWERED

CITY OF NEWARK PAYROLL TAX RETURN

1 . Gross Payroll this Quarter

3/2007

2. Gross Payroll Excluded

For Third Quarter ended Sept. 30, 2007 (payment due Oct. 31, 2007)

(from Schedule A. reverse)

3. Taxable Payroll

(line 1 less line 2)

Employer's Federal ID No.

4. Payroll Tax - 1 % (If Line 3 is

$2.500.00 or less, enter 0)

Employer's Name, Mailing Address and Telephone Number

Employer

5. Interest (if any)

___________________________________________________

Street or P.O. Box

___________________________________________________

6. Penalty (if any)

City, State and Zip Code

Make checks payable to:

7. Credit (Overpayments in prior

_______________________

years.)

"City of Newark-Payroll Tax"

Area Code– Telephone Number

Mail to: P.O. Box 15118

_______________________

8. Amount of this Payment (sum

Newark, New Jersey 07192

Block No.

Lot No.

of lines 4, 5 and 6) less line 7.

2007

I certify that

this is a

Date

correct return:

Form PK-3

Signature

Preparer’s Signature (Other than Taxpayer)

ALL OF THE ABOVE ITEMS MUST BE ANSWERED

CITY OF NEWARK PAYROLL TAX RETURN

1 . Gross Payroll this Quarter

4/2007

2. Gross Payroll Excluded

For Fourth Quarter ended Dec. 31, 2007 (payment due Jan 31, 2008)

(from Schedule A. reverse)

3. Taxable Payroll

(line 1 less line 2)

Employer's Federal ID No.

4. Payroll Tax - 1 % (If Line 3 is

$2.500.00 or less, enter 0)

Employer's Name, Mailing Address and Telephone Number

Employer

5. Interest (if any)

___________________________________________________

Street or P.O. Box

___________________________________________________

6. Penalty (if any)

City, State and Zip Code

Make checks payable to:

7. Credit (Overpayments in prior

_______________________

years.)

"City of Newark-Payroll Tax"

Area Code– Telephone Number

Mail to: P.O. Box 15118

_______________________

8. Amount of this Payment (sum

Newark, New Jersey 07192

Block No.

Lot No.

of lines 4, 5 and 6) less line 7.

2007

I certify that

this is a

Date

correct return:

Form PK-3

Signature

Preparer’s Signature (Other than Taxpayer)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4