Tax Form 9779 With Instructions (2007)

ADVERTISEMENT

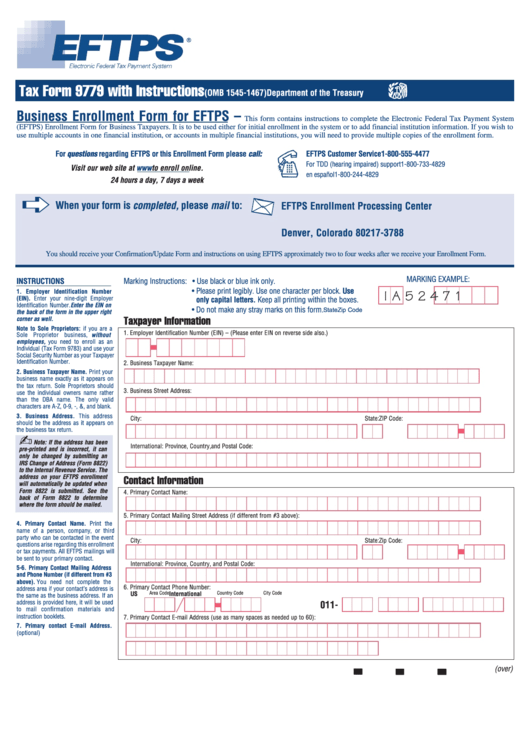

Tax Form 9779 with Instructions

(OMB 1545-1467)

Department of the Treasury

Business Enrollment Form for EFTPS –

This form contains instructions to complete the Electronic Federal Tax Payment System

(EFTPS) Enrollment Form for Business Taxpayers. It is to be used either for initial enrollment in the system or to add financial institution information. If you wish to

use multiple accounts in one financial institution, or accounts in multiple financial institutions, you will need to provide multiple copies of the enrollment form.

For questions regarding EFTPS or this Enrollment Form please call:

EFTPS Customer Service

1-800-555-4477

For TDD (hearing impaired) support

1-800-733-4829

Visit our web site at

to enroll online.

en español

1-800-244-4829

24 hours a day, 7 days a week

➪

When your form is completed, please mail to:

EFTPS Enrollment Processing Center

P.O. Box 173788

Denver, Colorado 80217-3788

You should receive your Confirmation/Update Form and instructions on using EFTPS approximately two to four weeks after we receive your Enrollment Form.

MARKING EXAMPLE:

INSTRUCTIONS

Marking Instructions: • Use black or blue ink only.

• Please print legibly. Use one character per block. Use

1. Employer Identification Number

I A

5 2 4 7 1

(EIN). Enter your nine-digit Employer

only capital letters. Keep all printing within the boxes.

Identification Number. Enter the EIN on

• Do not make any stray marks on this form.

State

Zip Code

the back of the form in the upper right

corner as well.

Taxpayer Information

Note to Sole Proprietors: if you are a

1. Employer Identification Number (EIN) – (Please enter EIN on reverse side also.)

Sole Proprietor business, without

employees, you need to enroll as an

Individual (Tax Form 9783) and use your

Social Security Number as your Taxpayer

Identification Number.

2. Business Taxpayer Name:

2. Business Taxpayer Name. Print your

business name exactly as it appears on

the tax return. Sole Proprietors should

3. Business Street Address:

use the individual owners name rather

than the DBA name. The only valid

characters are A-Z, 0-9, -, &, and blank.

3. Business Address. This address

City:

State:

ZIP Code:

should be the address as it appears on

the business tax return.

✍

Note: If the address has been

International: Province, Country, and Postal Code:

pre-printed and is incorrect, it can

only be changed by submitting an

IRS Change of Address (Form 8822)

to the Internal Revenue Service. The

address on your EFTPS enrollment

Contact Information

will automatically be updated when

Form 8822 is submitted. See the

4. Primary Contact Name:

back of Form 8822 to determine

where the form should be mailed.

5. Primary Contact Mailing Street Address (if different from #3 above):

4. Primary Contact Name. Print the

name of a person, company, or third

party who can be contacted in the event

City:

State:

Zip Code:

questions arise regarding this enrollment

or tax payments. All EFTPS mailings will

be sent to your primary contact.

International: Province, Country, and Postal Code:

5-6. Primary Contact Mailing Address

and Phone Number (if different from #3

above). You need not complete the

6. Primary Contact Phone Number:

address area if your contact’s address is

US

Area Code

International

Country Code

City Code

the same as the business address. If an

address is provided here, it will be used

011-

to mail confirmation materials and

instruction booklets.

7. Primary Contact E-mail Address (use as many spaces as needed up to 60):

7. Primary contact E-mail Address.

(optional)

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2