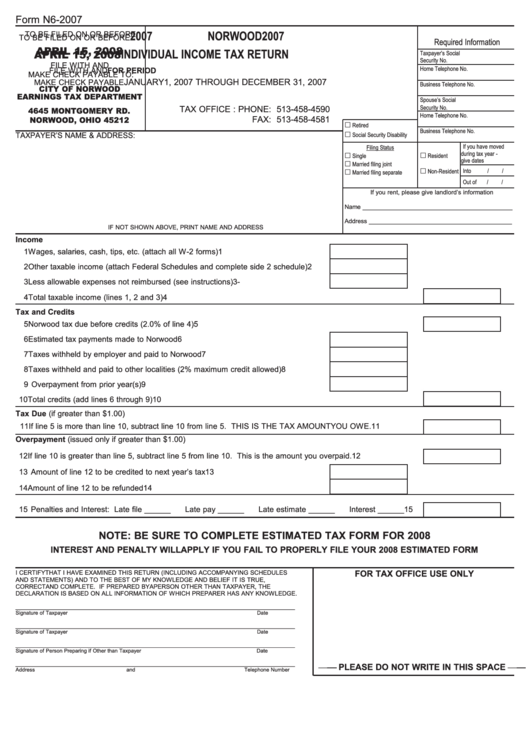

Form N6-2007 - Individual Income Tax Return

ADVERTISEMENT

Form N6-2007

2007

NORWOOD

2007

TO BE FILED ON OR BEFORE

TO BE FILED ON OR BEFORE

Required Information

APRIL 15, 2008

APRIL 15, 2008

INDIVIDUAL INCOME TAX RETURN

Taxpayer’s Social

Security No.

FILE WITH AND

Home Telephone No.

FILE WITH AND

FOR PERIOD

MAKE CHECK PAYABLE TO:

JANUARY 1, 2007 THROUGH DECEMBER 31, 2007

MAKE CHECK PAYABLE

Business Telephone No.

CITY OF NORWOOD

EARNINGS TAX DEPARTMENT

Spouse’s Social

TAX OFFICE : PHONE: 513-458-4590

Security No.

4645 MONTGOMERY RD.

Home Telephone No.

NORWOOD, OHIO 45212

FAX: 513-458-4581

£

Retired

Business Telephone No.

TAXPAYER’S NAME & ADDRESS:

£

Social Security Disability

If you have moved

Filing Status

during tax year -

£

£

Single

Resident

give dates

£

Married filing joint

£

Into

/

/

Non-Resident

£

Married filing separate

Out of

/

/

If you rent, please give landlord’s information

Name ____________________________________________

Address __________________________________________

IF NOT SHOWN ABOVE, PRINT NAME AND ADDRESS

Income

1 Wages, salaries, cash, tips, etc. (attach all W-2 forms)

1

2 Other taxable income (attach Federal Schedules and complete side 2 schedule)

2

3 Less allowable expenses not reimbursed (see instructions)

3

-

4 Total taxable income (lines 1, 2 and 3)

4

Tax and Credits

5 Norwood tax due before credits (2.0% of line 4)

5

6 Estimated tax payments made to Norwood

6

7 Taxes withheld by employer and paid to Norwood

7

8 Taxes withheld and paid to other localities (2% maximum credit allowed)

8

9 Overpayment from prior year(s)

9

10 Total credits (add lines 6 through 9)

10

Tax Due (if greater than $1.00)

11 If line 5 is more than line 10, subtract line 10 from line 5. THIS IS THE TAX AMOUNT YOU OWE.

11

Overpayment (issued only if greater than $1.00)

12 If line 10 is greater than line 5, subtract line 5 from line 10. This is the amount you overpaid.

12

13 Amount of line 12 to be credited to next year’s tax

13

14 Amount of line 12 to be refunded

14

15 Penalties and Interest: Late file ______

Late pay ______

Late estimate ______

Interest ______

15

NOTE: BE SURE TO COMPLETE ESTIMATED TAX FORM FOR 2008

INTEREST AND PENALTY WILL APPLY IF YOU FAIL TO PROPERLY FILE YOUR 2008 ESTIMATED FORM

FOR TAX OFFICE USE ONLY

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES

AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE,

CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE

DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

__________________________________________________________________________________

Signature of Taxpayer

Date

__________________________________________________________________________________

Signature of Taxpayer

Date

__________________________________________________________________________________

Signature of Person Preparing if Other than Taxpayer

Date

__________________________________________________________________________________

¾ ¾ PLEASE DO NOT WRITE IN THIS SPACE ¾ ¾

Address

and

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2