Form N6-2007 - Individual Income Tax Return Page 2

ADVERTISEMENT

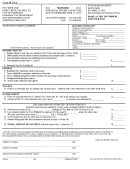

NORWOOD INCOME TAX FORM N6

SIDE TWO SCHEDULE

(Calculation for Line 2 Front Page)

16 Net profit(s)/loss from profession and/or business operation(s) Attach Federal Schedule C . . . . . . . . . . . (16) $___________________

17 Net profit(s)/loss from rental property and/or partnership(s) Attach Federal Schedule E . . . . . . . . . . . . . . (17) $___________________

18 Net profit(s)/loss from farm income Attach Federal Schedule F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18) $___________________

19 Total net profit(s)/losses from business activities (Lines 16, 17 and 18) . . . . . . . . . . . . . . . . . . . . . . . . .

(19) $___________________

20 Business losses from previous years’ tax returns (if available) Maximum of three (3) years carryover . . . (20) $___________________

21 Other taxable income from business activities (Total Line 19 and Line 20) . . . . . . . . . . . . . . . . . . . . .

(21) $___________________

Note: If this amount is a loss, it cannot be used to reduce salary, wages or other personnel service

income on Line 1, 4 or 22.

22 Other taxable income (see instructions - Lines 2 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22) $___________________

23 Total other taxable income (report this amount on Line 2 - front page) . . . . . . . . . . . . . . . . . . . . . . . . . . . (23) $___________________

ADDITIONAL INFORMATION

If your tax status has changed, please complete applicable items below:

A I permanently discontinued work and have no taxable income after: ________________________________ (State reason in “C” below)

B I sold the following rental property subject to Norwood tax:

Location Address:

Date Sold:

Purchaser’s Name and Address:

____________________________________

____________________

___________________________________________

____________________________________

____________________

___________________________________________

C Additional Notations: ___________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

FILING INSTRUCTIONS

MANDATORY FILING: All residents are required to file a return whether or not any tax is due and regardless if you rent or own. If for some reason, you do not have any taxable

income, please return your form with an explanation and applicable verification and documentation. If you do not respond, your account will be considered delinquent. To avoid

penalties and interest, your tax return and payment must be received on or before April 15th.

Line 1

Is to be the grand total of all gross wages, salaries and compensation from

Lines 13 and 14 Your overpayment may be either credited to next year’s taxes or

all W-2 forms for the tax year. Attach copies of W-2s and a copy of your

refunded to you.

Federal 1040 Form.

Line 15 Penalties and interest: Unpaid taxes accumulate penalties and interest at

Line 2

Is for reporting such items as income from business activities, non-

1% per month each (2% total per month). Minimum late penalty is $20.

employee income listed on a 1099-MISC, sales commissions, fees,

gambling winnings, and other 1099 income received not pursuant to

Lines 16 through 20 Self-explanatory - call the tax office with further questions.

retirement and other taxable income. (See note for Line 21.)

Line 21 Total of other taxable income from business activities. NOTE: LOSSES

Line 3

If during the tax year, you incurred expenses directly connected with your

FROM BUSINESS, INCLUDING RENTALS, MAY NOT BE OFFSET

employment and essential to your earnings, they are allowable as a

AGAINST PERSONAL SERVICES COMPENSATION. HOWEVER,

deduction from your gross earnings. Expenses are deductible only if

LOSSES MAY BE CARRIED OVER FOR A MAXIMUM OF THREE

recognized for Federal Income Tax purposes authorized by Norwood

YEARS.

Earnings Tax Regulations and required by your employer. Such items as

clothing, lodging, transportation to and from place of employment are not

Line 22 Show other taxable income not from business activities - see items listed

allowable. An itemized statement of all claimed expenses (copy of Federal

in Line 2 instructions.

travel expense sheet) must be furnished. All claimed expenses must be

substantiated by actual records. Federal 2106 expenses are allowed with

Line 23 Total of other income. Add Lines 21 and 22. This amount should be

accompanying schedule.

shown on front page, Line 2.

Line 4

Total taxable income for Norwood

Notes: Extension Policy - A copy of your federal extension or other written

request must be filed with the Norwood Tax Office by the due date of

Line 5

Tax due before credits - multiply Line 4 by 2%

the Norwood return. An extension does not extend the time to pay

taxes.

Line 6

Estimated tax payments made to Norwood for tax year 2007

Protection of Taxpayer Information - Any information gained as a result of

Line 7

Taxes withheld by employer and paid to Norwood

returns, investigations, etc. shall be confidential. No disclosures shall be

made except for official purposes or as ordered by a court of competent

Line 8

Taxes withheld by employer and paid to other localities

jurisdiction or where disclosure is necessary to the conduct of a hearing

before the Board of Appeals.

Line 9

Overpayments from prior years’ tax returns

Be sure to complete an estimated tax form for 2008 - Form N1.

Line 10 Total credit for the tax year

RETIREES: If you not longer work at all, please attach a copy of your

Line 11 This is your tax due. Subtract Line 10 from Line 5. Balance must be

annual Social Security statement and a copy of your annual 1099 Form

remitted with this return.

for your pension received, if any. Also, indicate the date of your retirement

on Line C above OR provide a statement from your former employer

Line 12 This is the amount you overpaid. Subtract Line 5 from Line 10.

showing your retirement date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2