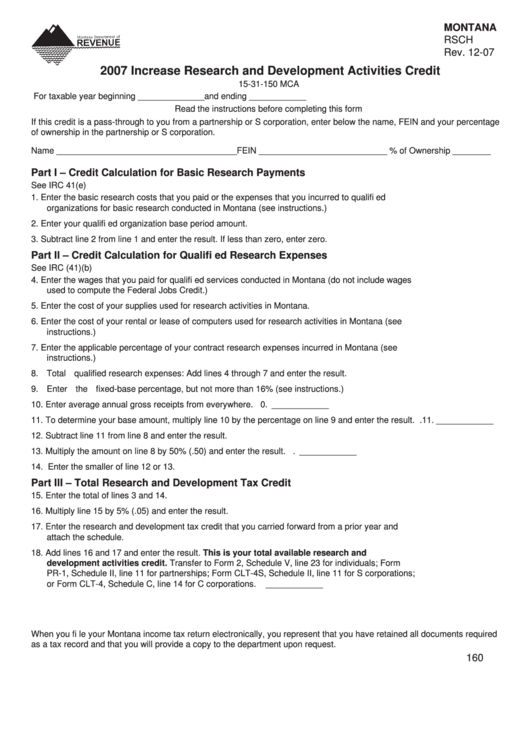

MONTANA

RSCH

Rev. 12-07

2007 Increase Research and Development Activities Credit

15-31-150 MCA

For taxable year beginning ______________ and ending ____________

Read the instructions before completing this form

If this credit is a pass-through to you from a partnership or S corporation, enter below the name, FEIN and your percentage

of ownership in the partnership or S corporation.

Name ______________________________________FEIN ___________________________ % of Ownership ________

Part I – Credit Calculation for Basic Research Payments

See IRC 41(e)

1. Enter the basic research costs that you paid or the expenses that you incurred to qualifi ed

organizations for basic research conducted in Montana (see instructions.) ........................................ 1. ____________

2. Enter your qualifi ed organization base period amount. ........................................................................ 2. ____________

3. Subtract line 2 from line 1 and enter the result. If less than zero, enter zero. ...................................... 3. ____________

Part II – Credit Calculation for Qualifi ed Research Expenses

See IRC (41)(b)

4. Enter the wages that you paid for qualifi ed services conducted in Montana (do not include wages

used to compute the Federal Jobs Credit.) .......................................................................................... 4. ____________

5. Enter the cost of your supplies used for research activities in Montana. ............................................. 5. ____________

6. Enter the cost of your rental or lease of computers used for research activities in Montana (see

instructions.) ......................................................................................................................................... 6. ____________

7. Enter the applicable percentage of your contract research expenses incurred in Montana (see

instructions.) ......................................................................................................................................... 7. ____________

8. Total qualifi ed research expenses: Add lines 4 through 7 and enter the result. ................................... 8. ____________

9. Enter the fi xed-base percentage, but not more than 16% (see instructions.) ...................................... 9. ____________

10. Enter average annual gross receipts from everywhere. .................................................................... 10. ____________

11. To determine your base amount, multiply line 10 by the percentage on line 9 and enter the result. . 11. ____________

12. Subtract line 11 from line 8 and enter the result. ............................................................................... 12. ____________

13. Multiply the amount on line 8 by 50% (.50) and enter the result. ....................................................... 13. ____________

14. Enter the smaller of line 12 or 13. ...................................................................................................... 14. ____________

Part III – Total Research and Development Tax Credit

15. Enter the total of lines 3 and 14. ........................................................................................................ 15. ____________

16. Multiply line 15 by 5% (.05) and enter the result. ............................................................................... 16. ____________

17. Enter the research and development tax credit that you carried forward from a prior year and

attach the schedule. ........................................................................................................................... 17. ____________

18. Add lines 16 and 17 and enter the result. This is your total available research and

development activities credit. Transfer to Form 2, Schedule V, line 23 for individuals; Form

PR-1, Schedule II, line 11 for partnerships; Form CLT-4S, Schedule II, line 11 for S corporations;

or Form CLT-4, Schedule C, line 14 for C corporations. .................................................................... 18. ____________

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

160

1

1