Montana Form Rsch - Increase Research And Development Activities Credit - 2008

ADVERTISEMENT

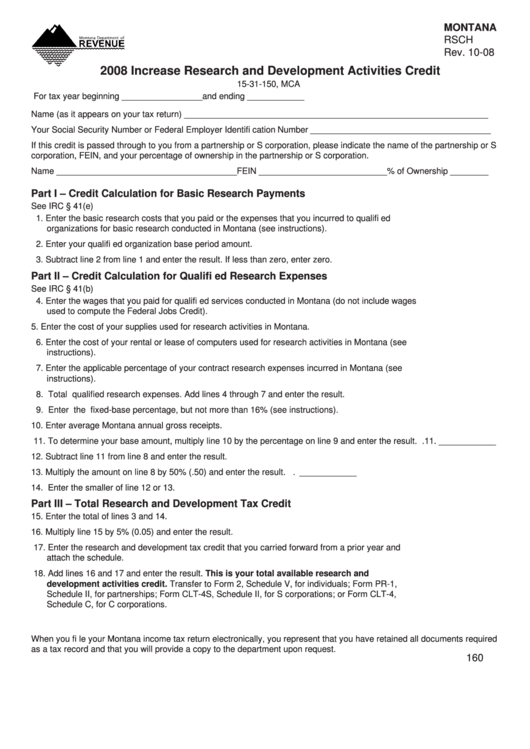

MONTANA

RSCH

Rev. 10-08

2008 Increase Research and Development Activities Credit

15-31-150, MCA

For tax year beginning _________________ and ending ____________

Name (as it appears on your tax return) ________________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number ______________________________________

If this credit is passed through to you from a partnership or S corporation, please indicate the name of the partnership or S

corporation, FEIN, and your percentage of ownership in the partnership or S corporation.

Name ______________________________________FEIN ___________________________ % of Ownership ________

Part I – Credit Calculation for Basic Research Payments

See IRC § 41(e)

1. Enter the basic research costs that you paid or the expenses that you incurred to qualifi ed

organizations for basic research conducted in Montana (see instructions). ........................................ 1. ____________

2. Enter your qualifi ed organization base period amount. ........................................................................ 2. ____________

3. Subtract line 2 from line 1 and enter the result. If less than zero, enter zero. ...................................... 3. ____________

Part II – Credit Calculation for Qualifi ed Research Expenses

See IRC § 41(b)

4. Enter the wages that you paid for qualifi ed services conducted in Montana (do not include wages

used to compute the Federal Jobs Credit). .......................................................................................... 4. ____________

5. Enter the cost of your supplies used for research activities in Montana. ............................................. 5. ____________

6. Enter the cost of your rental or lease of computers used for research activities in Montana (see

instructions). ......................................................................................................................................... 6. ____________

7. Enter the applicable percentage of your contract research expenses incurred in Montana (see

instructions). ......................................................................................................................................... 7. ____________

8. Total qualifi ed research expenses. Add lines 4 through 7 and enter the result. ................................... 8. ____________

9. Enter the fi xed-base percentage, but not more than 16% (see instructions). ...................................... 9. ____________

10. Enter average Montana annual gross receipts. ................................................................................. 10. ____________

11. To determine your base amount, multiply line 10 by the percentage on line 9 and enter the result. . 11. ____________

12. Subtract line 11 from line 8 and enter the result. ............................................................................... 12. ____________

13. Multiply the amount on line 8 by 50% (.50) and enter the result. ....................................................... 13. ____________

14. Enter the smaller of line 12 or 13. ...................................................................................................... 14. ____________

Part III – Total Research and Development Tax Credit

15. Enter the total of lines 3 and 14. ........................................................................................................ 15. ____________

16. Multiply line 15 by 5% (0.05) and enter the result. ............................................................................. 16. ____________

17. Enter the research and development tax credit that you carried forward from a prior year and

attach the schedule. ........................................................................................................................... 17. ____________

18. Add lines 16 and 17 and enter the result. This is your total available research and

development activities credit. Transfer to Form 2, Schedule V, for individuals; Form PR-1,

Schedule II, for partnerships; Form CLT-4S, Schedule II, for S corporations; or Form CLT-4,

Schedule C, for C corporations. ......................................................................................................... 18. ____________

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

160

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3