Tab within form to navigate. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

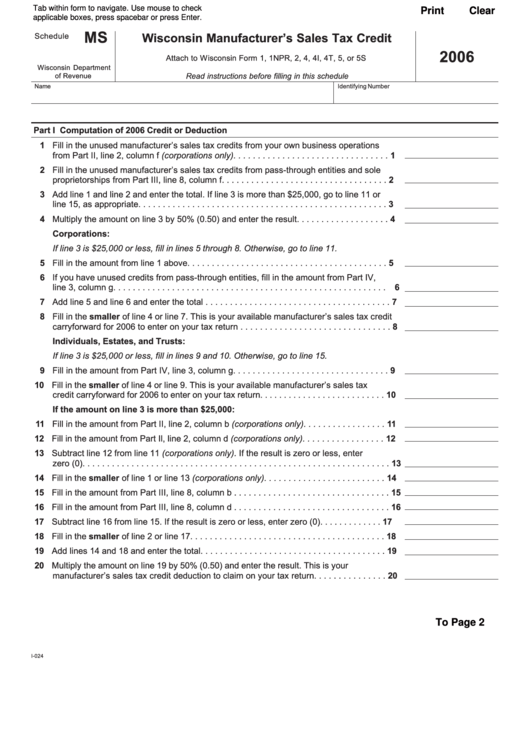

MS

Wisconsin Manufacturer’s Sales Tax Credit

Schedule

2006

Attach to Wisconsin Form 1, 1NPR, 2, 4, 4I, 4T, 5, or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Identifying Number

Part I Computation of 2006 Credit or Deduction

1 Fill in the unused manufacturer’s sales tax credits from your own business operations

from Part II, line 2, column f (corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Fill in the unused manufacturer’s sales tax credits from pass-through entities and sole

proprietorships from Part III, line 8, column f . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add line 1 and line 2 and enter the total. If line 3 is more than $25,000, go to line 11 or

line 15, as appropriate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Multiply the amount on line 3 by 50% (0.50) and enter the result . . . . . . . . . . . . . . . . . . .

4

Corporations:

If line 3 is $25,000 or less, fill in lines 5 through 8. Otherwise, go to line 11.

5 Fill in the amount from line 1 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 If you have unused credits from pass-through entities, fill in the amount from Part IV,

line 3, column g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Add line 5 and line 6 and enter the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Fill in the smaller of line 4 or line 7. This is your available manufacturer’s sales tax credit

carryforward for 2006 to enter on your tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Individuals, Estates, and Trusts:

If line 3 is $25,000 or less, fill in lines 9 and 10. Otherwise, go to line 15.

9 Fill in the amount from Part IV, line 3, column g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Fill in the smaller of line 4 or line 9. This is your available manufacturer’s sales tax

credit carryforward for 2006 to enter on your tax return . . . . . . . . . . . . . . . . . . . . . . . . . . 10

If the amount on line 3 is more than $25,000:

11 Fill in the amount from Part II, line 2, column b (corporations only) . . . . . . . . . . . . . . . . . 11

12 Fill in the amount from Part Il, line 2, column d (corporations only) . . . . . . . . . . . . . . . . . 12

13 Subtract line 12 from line 11 (corporations only). If the result is zero or less, enter

zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Fill in the smaller of line 1 or line 13 (corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Fill in the amount from Part III, line 8, column b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Fill in the amount from Part III, line 8, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 15. If the result is zero or less, enter zero (0) . . . . . . . . . . . . . 17

18 Fill in the smaller of line 2 or line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Add lines 14 and 18 and enter the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Multiply the amount on line 19 by 50% (0.50) and enter the result. This is your

manufacturer’s sales tax credit deduction to claim on your tax return . . . . . . . . . . . . . . . 20

To Page 2

I-024

1

1 2

2 3

3