Form L-1120 - City Of Lapeer Corporation Income Tax Return

ADVERTISEMENT

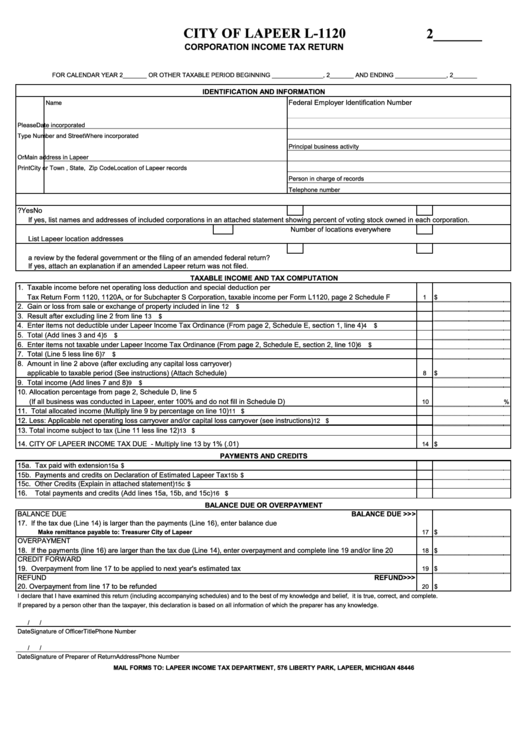

CITY OF LAPEER L-1120

2_______

CORPORATION INCOME TAX RETURN

FOR CALENDAR YEAR 2_______ OR OTHER TAXABLE PERIOD BEGINNING _______________, 2_______ AND ENDING _______________, 2_______

IDENTIFICATION AND INFORMATION

Federal Employer Identification Number

Name

Please

Date incorporated

Type

Number and Street

Where incorporated

Principal business activity

Or

Main address in Lapeer

Print

City or Town , State, Zip Code

Location of Lapeer records

Person in charge of records

Telephone number

A. Name and Address of resident agent in Michigan

B. Is this a consolidated return?

Yes

No

If yes, list names and addresses of included corporations in an attached statement showing percent of voting stock owned in each corporation.

C. Number of Lapeer locations included in this return.

Number of locations everywhere

List Lapeer location addresses

D. Was your federal tax liability for any other year changed by either

Yes

No

a review by the federal government or the filing of an amended federal return?

If yes, attach an explanation if an amended Lapeer return was not filed.

TAXABLE INCOME AND TAX COMPUTATION

1. Taxable income before net operating loss deduction and special deduction per U.S. Corporation Income

Tax Return Form 1120, 1120A, or for Subchapter S Corporation, taxable income per Form L1120, page 2 Schedule F

1

$

2. Gain or loss from sale or exchange of property included in line 1

2

$

3. Result after excluding line 2 from line 1

3

$

4. Enter items not deductible under Lapeer Income Tax Ordinance (From page 2, Schedule E, section 1, line 4)

4

$

5. Total (Add lines 3 and 4)

5

$

6. Enter items not taxable under Lapeer Income Tax Ordinance (From page 2, Schedule E, section 2, line 10)

6

$

7. Total (Line 5 less line 6)

7

$

8. Amount in line 2 above (after excluding any capital loss carryover)

applicable to taxable period (See instructions) (Attach Schedule)

8

$

9. Total income (Add lines 7 and 8)

9

$

10. Allocation percentage from page 2, Schedule D, line 5

(If all business was conducted in Lapeer, enter 100% and do not fill in Schedule D)

10

%

11. Total allocated income (Multiply line 9 by percentage on line 10)

11 $

12. Less: Applicable net operating loss carryover and/or capital loss carryover (see instructions)

12 $

13. Total income subject to tax (Line 11 less line 12)

13 $

14. CITY OF LAPEER INCOME TAX DUE - Multiply line 13 by 1% (.01)

14

$

PAYMENTS AND CREDITS

15a. Tax paid with extension

15a $

15b. Payments and credits on Declaration of Estimated Lapeer Tax

15b $

15c. Other Credits (Explain in attached statement)

15c $

16.

Total payments and credits (Add lines 15a, 15b, and 15c)

16 $

BALANCE DUE OR OVERPAYMENT

BALANCE DUE

BALANCE DUE >>>

17. If the tax due (Line 14) is larger than the payments (Line 16), enter balance due

Make remittance payable to: Treasurer City of Lapeer

17

$

OVERPAYMENT

18. If the payments (line 16) are larger than the tax due (Line 14), enter overpayment and complete line 19 and/or line 20

18

$

CREDIT FORWARD

19. Overpayment from line 17 to be applied to next year's estimated tax

19

$

REFUND

REFUND>>>

20. Overpayment from line 17 to be refunded

20 $

I declare that I have examined this return (including accompanying schedules) and to the best of my knowledge and belief, it is true, correct, and complete.

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

/

/

Date

Signature of Officer

Title

Phone Number

/

/

Date

Signature of Preparer of Return

Address

Phone Number

MAIL FORMS TO: LAPEER INCOME TAX DEPARTMENT, 576 LIBERTY PARK, LAPEER, MICHIGAN 48446

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2