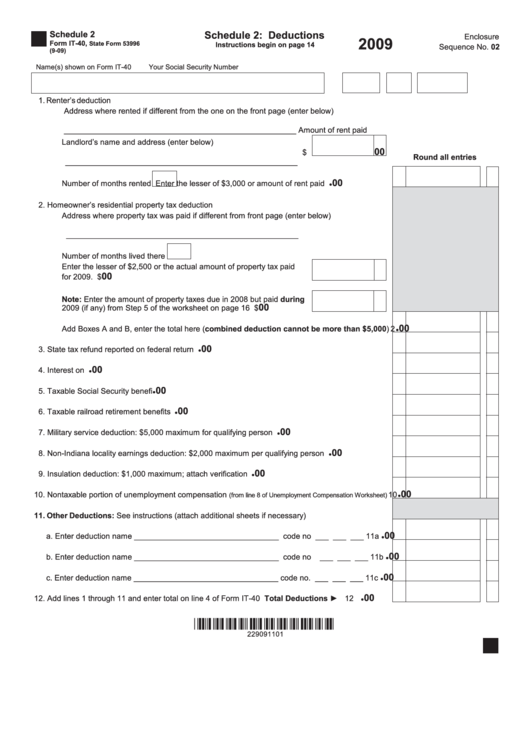

Schedule 2: Deductions

Schedule 2

Enclosure

2009

Form IT-40,

State Form 53996

Instructions begin on page 14

Sequence No. 02

(9-09)

Name(s) shown on Form IT-40

Your Social Security Number

1. Renter’s deduction

Address where rented if different from the one on the front page (enter below)

_____________________________________________________

Amount of rent paid

Landlord’s name and address (enter below)

00

$

Round all entries

_____________________________________________________

00

Number of months rented

Enter the lesser of $3,000 or amount of rent paid .........

1

●

2. Homeowner’s residential property tax deduction

Address where property tax was paid if different from front page (enter below)

_____________________________________________________

Number of months lived there

Enter the lesser of $2,500 or the actual amount of property tax paid

00

for 2009. ......................................................................................Box A $

Note: Enter the amount of property taxes due in 2008 but paid during

00

2009 (if any) from Step 5 of the worksheet on page 16 .............Box B $

00

Add Boxes A and B, enter the total here (combined deduction cannot be more than $5,000)

2

●

00

3. State tax refund reported on federal return .........................................................................................

3

●

00

4. Interest on U.S. government obligations .............................................................................................

4

●

00

5. Taxable Social Security benefi ts..........................................................................................................

5

●

00

6. Taxable railroad retirement benefi ts ....................................................................................................

6

●

00

7. Military service deduction: $5,000 maximum for qualifying person .....................................................

7

●

00

8. Non-Indiana locality earnings deduction: $2,000 maximum per qualifying person .............................

8

●

00

9. Insulation deduction: $1,000 maximum; attach verifi cation .................................................................

9

●

00

10. Nontaxable portion of unemployment compensation

10

(from line 8 of Unemployment Compensation Worksheet)

●

11. Other Deductions: See instructions (attach additional sheets if necessary)

00

a. Enter deduction name _________________________________

code no ___ ___ ___

11a

●

00

b. Enter deduction name _________________________________

code no ___ ___ ___

11b

●

00

c. Enter deduction name _________________________________

code no. ___ ___ ___

11c

●

00

12. Add lines 1 through 11 and enter total on line 4 of Form IT-40 ...........................Total Deductions ► 12

●

229091101

1

1