Form It-40 Schedule 3 & 4 Draft - Exemptions - 2009

ADVERTISEMENT

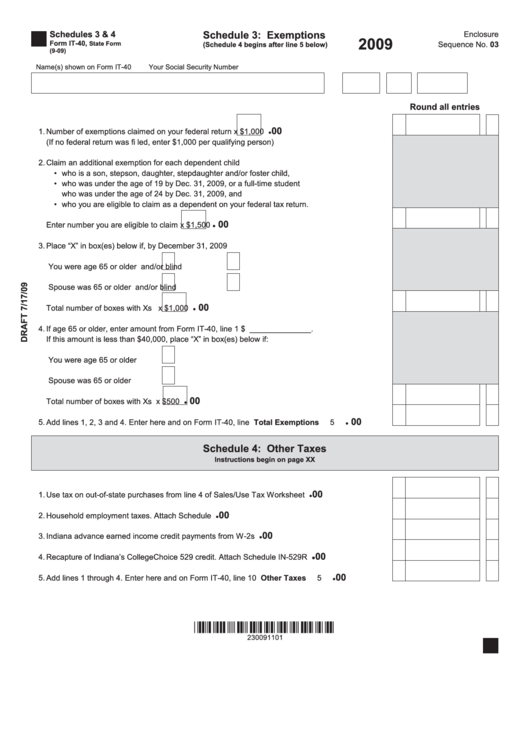

Schedules 3 & 4

Schedule 3: Exemptions

Enclosure

2009

Form IT-40,

State Form

Sequence No. 03

(Schedule 4 begins after line 5 below)

(9-09)

Name(s) shown on Form IT-40

Your Social Security Number

Round all entries

00

1.

Number of exemptions claimed on your federal return

x $1,000 ...........................................

1

●

(If no federal return was fi led, enter $1,000 per qualifying person)

2.

Claim an additional exemption for each dependent child

•

who is a son, stepson, daughter, stepdaughter and/or foster child,

•

who was under the age of 19 by Dec. 31, 2009, or a full-time student

who was under the age of 24 by Dec. 31, 2009, and

•

who you are eligible to claim as a dependent on your federal tax return.

00

Enter number you are eligible to claim

x $1,500 ....................................................................

2

●

3.

Place “X” in box(es) below if, by December 31, 2009

You were age 65 or older

and/or blind

Spouse was 65 or older

and/or blind

00

Total number of boxes with Xs

x $1,000 ............................................................................

3

●

4.

If age 65 or older, enter amount from Form IT-40, line 1 $ ______________ .

If this amount is less than $40,000, place “X” in box(es) below if:

You were age 65 or older

Spouse was 65 or older

00

Total number of boxes with Xs

x $500 ................................................................................

4

●

00

5.

Add lines 1, 2, 3 and 4. Enter here and on Form IT-40, line 6................................ Total Exemptions

5

●

Schedule 4: Other Taxes

Instructions begin on page XX

00

1.

Use tax on out-of-state purchases from line 4 of Sales/Use Tax Worksheet .......................................

1

●

00

2.

Household employment taxes. Attach Schedule IN-H..........................................................................

2

●

00

3.

Indiana advance earned income credit payments from W-2s ..............................................................

3

●

00

4.

Recapture of Indiana’s CollegeChoice 529 credit. Attach Schedule IN-529R ......................................

4

●

00

5.

Add lines 1 through 4. Enter here and on Form IT-40, line 10 ........................................ Other Taxes

5

●

230091101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1