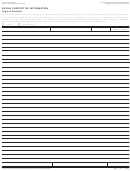

SUPPLEMENTAL FINANCIAL INFORMATION

GENERAL INFORMATION AND INSTRUCTIONS

GENERAL INFORMATION

Each applicant/licensee must submit a LIC 401a Supplemental Financial Information, Part II. In addition, part I is to be completed for

a sole proprietorship only. FOR GENERAL PARTNERS, - Each general partner must submit a personal 401a.

Information reported in these documents is subject to verification. Therefore, additional documentation may be requested to support

any or all of the items reported.

INSTRUCTIONS

Please include the required information at the top of this form to identify the 1) reporting period for the information, 2) name of the sole

proprietorship, partner, general partnership or corporation for whom the information applies, 3) facility name, and 4) application or license

number.

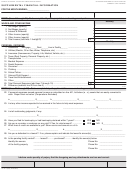

PART I - PERSONAL INCOME AND EXPENSES (This section is to be completed by sole proprietors and each general partner of

a partnership).

PERSONAL INCOME (DO NOT REPORT ANY INCOME ALREADY REPORTED ON THE LIC 401)

Line #

1-2. Report the first & last name of the person, the source and the amount of monthly wages or other income.

3.

Report the name of the financial agency paying all interest and dividends earned per month. You may report the combined

amount.

4-5. Report other income source and amount.

PERSONAL EXPENSES (DO NOT REPORT ANY EXPENSES ALREADY REPORTED ON THE LIC 401)

7.

Indicate whether you pay on a mortgage or pay rent. (This refers to expenses other than those shown on line 26 of the LIC

401.) Report amount of payment.

8.

Cost of utilities (electric, oil or gas, water, telephone, etc.)

9.

Cost of insurance (homeowners, property, life, medical, vehicle, etc.)

10. Taxes paid for real or personal property, etc.

11. Cost of transportation including fuel and maintenance.

12. Cost of medical expenses (doctor visits, medications, etc.)

13. Cost of dental care.

14. Cost of groceries, household supplies, etc.

15. Cost of family clothing needs.

16. Cost for school tuition and/or other education expenses.

17. Alimony and/or child care support payments.

18. Cost for travel and entertainment.

19. Other costs not included above.

PART II. OTHER PERSONAL INFORMATION (To be completed by all applicants)

22. If your personal expenses exceed personal income, then list other assets owned by you that are readily convertible to cash,

and show the net value of those assets. The net value is the market value less any associated debt on the asset.

23. Describe and show other anticipated income not already included in lines 1 through 5 above.

24. Show all judgments against you and the amount.

25. Check either “YES’ or “NO” as appropriate. If YES, submit proof of discharge of debt.

26. Check either “YES” or “NO” as appropriate. If YES, then show amount which is still owed on the note.

27. If you have lines of credit available, show the source for the line of credit and the amount of credit available.

28. If you are a defendant in a lawsuit, briefly explain the circumstance.

29. If, for instance, where the facility property is being purchased, list all mortgage holders (first, second and third trust deed

lenders, if applicable) and their telephone numbers.

SIGNATURE BLOCK

The name of the preparer is to be printed in the space provided. The applicant or licensee is required to sign this form attesting

to the financial information. Failure to sign, date and attest to the accuracy of the information on the Supplemental Financial

Information Statement (LIC 401a) shall constitute non-compliance and the rejection of this report..

1

1 2

2