Form Cmft-2-X - General Information

ADVERTISEMENT

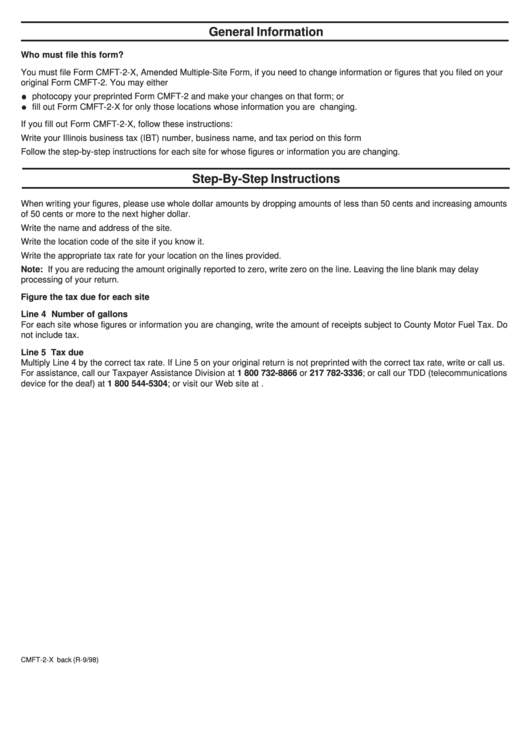

General Information

Who must file this form?

You must file Form CMFT-2-X, Amended Multiple-Site Form, if you need to change information or figures that you filed on your

original Form CMFT-2. You may either

photocopy your preprinted Form CMFT-2 and make your changes on that form; or

fill out Form CMFT-2-X for only those locations whose information you are changing.

If you fill out Form CMFT-2-X, follow these instructions:

Write your Illinois business tax (IBT) number, business name, and tax period on this form

Follow the step-by-step instructions for each site for whose figures or information you are changing.

Step-By-Step Instructions

When writing your figures, please use whole dollar amounts by dropping amounts of less than 50 cents and increasing amounts

of 50 cents or more to the next higher dollar.

Write the name and address of the site.

Write the location code of the site if you know it.

Write the appropriate tax rate for your location on the lines provided.

Note: If you are reducing the amount originally reported to zero, write zero on the line. Leaving the line blank may delay

processing of your return.

Figure the tax due for each site

Line 4 Number of gallons

For each site whose figures or information you are changing, write the amount of receipts subject to County Motor Fuel Tax. Do

not include tax.

Line 5 Tax due

Multiply Line 4 by the correct tax rate. If Line 5 on your original return is not preprinted with the correct tax rate, write or call us.

For assistance, call our Taxpayer Assistance Division at 1 800 732-8866 or 217 782-3336; or call our TDD (telecommunications

device for the deaf) at 1 800 544-5304; or visit our Web site at

CMFT-2-X back (R-9/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1