Form De 231mw - Reporting And Payment Following An Assessment For Misclassified Workers Page 3

ADVERTISEMENT

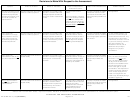

Decisions to Make With Respect to the Assessment

Options

Effect on Interest

Effect on Penalties

Effect on Department

Effect on PIT Abatements

Petition Results

Collection Actions

Pay the assessment in full

Interest charged on the unpaid

Additional 10% penalty under

If paid in full, there is no

Properly completed DE 938Ps

Not applicable.

or enter into an approved

balance to date of payment.

Section 1135 CUIC will not be

action.

will result in refund or credit

installment payment plan

charged if paid in full within 30

for personal income tax (PIT)

with the Department,* and

days from date of assessment

If a payment plan is entered

and appropriate penalties and

do not file a petition for

notice.

into, no involuntary collection

interest.

reassessment.

action will be initiated if the

payment plan is maintained

by the employer. A tax lien

may be filed to protect the

state’s interests.

File a petition for

Interest charged on the unpaid

Additional 10% penalty under

The Department will not

Properly completed DE 938Ps

If a final CUIAB decision is in

reassessment, and pay

balance to date of payment.

Section 1135 CUIC will not be

institute collection actions

will result in refund or credit for

your favor, the amounts paid

the assessment in full or

charged if paid in full within 30

unless the employer fails to

PIT and appropriate penalties

are refunded with interest. Any

enter into an approved

days from date of assessment

maintain the payment plan

and interest.

unpaid portion of the assess-

installment payment plan

notice or within 30 days from a

and 30 days have elapsed

ment will be canceled. If it is not

with the Department.*

final CUIAB decision.

following a CUIAB decision.

in your favor, 30 days from the

date of the decision the

assessment is final, and an

additional 10% penalty is

charged on any unpaid

contributions.

If a CUIAB decision is in your

File a petition for

Interest continues to accrue on

Additional 10% penalty under

The Department will not

Properly completed DE 938Ps

favor, the assessment will be

reassessment and do not

unpaid liability.

Section 1135 does not appy until

institute collection actions on

will result in credit for PIT and

pay the assessment.

30 days from a final CUIAB

a petitioned liability until 30

appropriate penalties and

canceled. If it is not in your

favor, the assessment is final

decision.

days after a final decision is

interest.

issued by the CUIAB.

30 days from the date of the

decision and an additional 10%

penalty under Section 1135

CUIC is charged on unpaid

contributions. The Department

will then commence collection

action unless full payment is

made or arrangements are

made to pay the liability through

installment payments.*

Additional 10% penalty under

The Department will institute

Not applicable.

Do not pay the assess-

Interest continues to accrue on

Properly completed DE 938Ps

collection actions unless full

ment or file a petition for

unpaid liability.

Section 1135 CUIC will be

will result in credit for PIT and

payment is made or

charged when not paid in full

reassessment.

appropriate penalties and

arrangements are made to

within 30 days from date of

interest.

pay the liability through

assessment notice.

installment payments.*

*Please refer to Information Sheet: Payment Proposal, DE 631P, for additional information about, and qualifications for, installment payment plans.

SEE PAGE 4 FOR ADDITIONAL INFORMATION

DE 231MW Rev. 2 (1-01) (INTERNET)

Page 3 of 4

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4