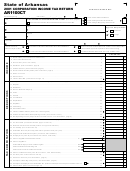

Form 20c - Corporation Income Tax Return - 2001 Page 4

ADVERTISEMENT

PAGE 4

ALABAMA 20C – 2001

Schedule E

Federal Income Tax

(a) If this corporation is an accrual-basis taxpayer and files a separate

consolidated federal return, indicate the number of the election made under IRC §1552.

(nonconsolidated) federal income tax return with the IRS, enter on line 1

1552(a)(1)

1552(a)(2)

1552(a)(3)

below the amount of federal income tax liability shown on Form 1120.

No Election Made

Other __________________________________________

Cash-basis taxpayers filing separate (nonconsolidated) federal returns

Attach a copy of the common parent corporation’s current 1552 election letter.

should enter on line 1 below the amount of federal income tax actually

Enter on line 1 the amount of the consolidated tax liability allocated to this corporation

paid during the year.

under the method indicated above. Ignore any supplemental elections under IRC

(b) If this corporation is a member of an affiliated group which files a

§1502. Attach a schedule of your computations.

1

1 Federal income tax deduction to be apportioned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Corporations not apportioning income should omit lines 2 through 4, and enter this amount on line 5.

2

2 Alabama income (from line 8, page 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Adjusted total income (from line 4, page 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

%

4 Federal income tax apportionment factor (line 2 divided by line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Federal income tax deduction apportioned to Alabama (multiply line 1 by line 4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Refund of federal income tax deducted in prior year(s) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 NET FEDERAL INCOME TAX DEDUCTION / (REFUND) (subtract line 6 from line 5). Enter here and on line 11, page 1 . . . . . . . .

Schedule F

Credits/Exemptions Caution – See Instructions

1 Alabama Enterprise Zone Credit/Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Employer Education Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Income Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Tax Increment Fund Payment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Coal Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Capital Tax Credit (Project Number(s) ______________________, ______________________) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 TOTAL (add lines 1 through 6). Enter here and on line 16d, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

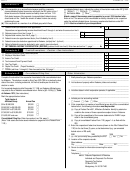

Schedule G

Consolidated Filing Fee

Other Information

1. Briefly describe your Alabama operations. ____________________________

Complete this schedule if the corporation has elected to file a consolidated return

______________________________________________________________

for Alabama. The election is made by filing Form 20C-CRE on or before the due

2. List locations of property within Alabama (cities and counties).

date of the return, including extensions, for the first taxable year for which the

______________________________________________________________

election is made.

______________________________________________________________

For tax periods beginning after December 31, 1998, an Alabama affiliated group

3. List other states in which corporation operates, if applicable. ______________

may elect to file an Alabama consolidated return. Refer to §40-18-39(c)(1), Code

______________________________________________________________

of Alabama 1975. (See instructions.)

______________________________________________________________

Mark the appropriate box below:

4. Indicate your tax accounting method:

Total Assets of

Accrual

Cash

Other _________________________________

Affiliated Group

Annual Fee

5. If this corporation is a member of an affiliated group which files a consolidated

$0 to $2,500,000

$2,500

federal return, the following information must be provided:

$2,500,001 to $5,000,000

$5,000

(a) Copy of Federal Form 851, Affiliations Schedule. Identify by asterisk or

$5,000,001 to $7,500,000

$7,500

underline the names of those corporations subject to tax in Alabama.

$7,500,001 to $10,000,000

$10,000

(b) Copy of the spreadsheet of the income statements for EVERY corpo-

$10,000,001 and over

$12,500

ration in the consolidated group.

Consolidated Filing Fee. (Enter here and on Line 15b, page 1) ______________

(c) Copy of consolidated Federal Form 1120, pages 1-4, as filed with the

(Note: Total assets are those assets indicated on page one of the Federal Form

IRS.

1120.)

6. Enter this corporation’s federal net income (shown on line 28 of Federal Form

1120) for the last three (3) years, as last determined (e.g.: per amended

federal return or IRS audit).

2000 _______________ 1999 _____________ 1998 _______________

7. (a) Are you currently being audited by the IRS?

Yes

No

8. Location of the corporate records:

Street address: _________________________________________________

City: _________________________ State: __________ ZIP: ____________

9. Person to contact for information concerning this return:

Name: ________________________________________________________

Telephone: ( _______ )______________________

Mail to: Alabama Department of Revenue

Individual and Corporate Tax Division

Corporate Tax Section

PO Box 327430

Montgomery, AL 36132-7430

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4