Tab to navigate within form. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

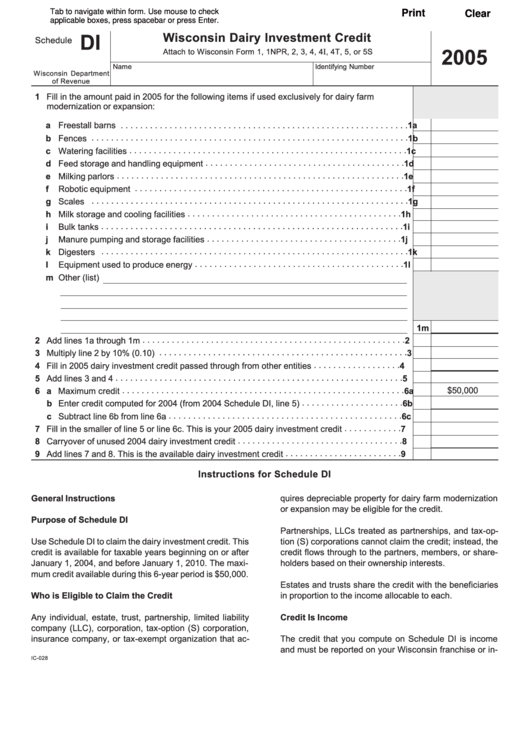

Wisconsin Dairy Investment Credit

DI

Schedule

2005

I

Attach to Wisconsin Form 1, 1NPR, 2, 3, 4, 4

, 4T, 5, or 5S

Name

Identifying Number

Wisconsin Department

of Revenue

1 Fill in the amount paid in 2005 for the following items if used exclusively for dairy farm

modernization or expansion:

a Freestall barns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

b Fences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

c Watering facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

d Feed storage and handling equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1d

e Milking parlors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1e

Robotic equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f

1f

g Scales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1g

h Milk storage and cooling facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1h

Bulk tanks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

1i

Manure pumping and storage facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

j

1j

k Digesters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1k

Equipment used to produce energy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

l

1l

m Other (list)

1m

2 Add lines 1a through 1m . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Multiply line 2 by 10% (0.10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Fill in 2005 dairy investment credit passed through from other entities . . . . . . . . . . . . . . . . . .

4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 a Maximum credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$50,000

6a

b Enter credit computed for 2004 (from 2004 Schedule DI, line 5) . . . . . . . . . . . . . . . . . . . . .

6b

c Subtract line 6b from line 6a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6c

7 Fill in the smaller of line 5 or line 6c. This is your 2005 dairy investment credit . . . . . . . . . . . .

7

8 Carryover of unused 2004 dairy investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Add lines 7 and 8. This is the available dairy investment credit . . . . . . . . . . . . . . . . . . . . . . . .

9

Instructions for Schedule DI

General Instructions

quires depreciable property for dairy farm modernization

or expansion may be eligible for the credit.

Purpose of Schedule DI

Partnerships, LLCs treated as partnerships, and tax-op-

Use Schedule DI to claim the dairy investment credit. This

tion (S) corporations cannot claim the credit; instead, the

credit is available for taxable years beginning on or after

credit flows through to the partners, members, or share-

January 1, 2004, and before January 1, 2010. The maxi-

holders based on their ownership interests.

mum credit available during this 6-year period is $50,000.

Estates and trusts share the credit with the beneficiaries

Who is Eligible to Claim the Credit

in proportion to the income allocable to each.

Any individual, estate, trust, partnership, limited liability

Credit Is Income

company (LLC), corporation, tax-option (S) corporation,

insurance company, or tax-exempt organization that ac-

The credit that you compute on Schedule DI is income

and must be reported on your Wisconsin franchise or in-

IC-028

1

1