Form Wvmft-509b-Retker - Motor Fuel Excise Tax Refund Application For Retailers Of Undyed Kerosene Sold For Home Heating Use (From A Blocked Pump)

ADVERTISEMENT

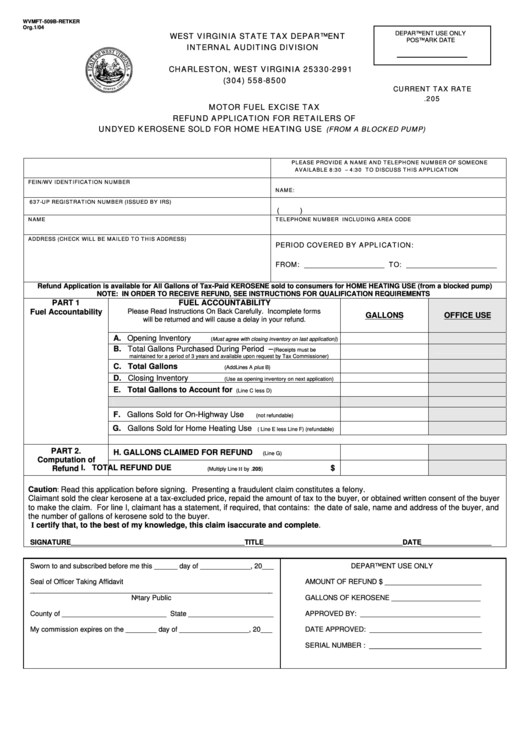

WVMFT-509B-RETKER

Org.1/04

WEST VIRGINIA STATE TAX DEPARTMENT

DEPARTMENT USE ONLY

POSTMARK DATE

INTERNAL AUDITING DIVISION

P.O. BOX 2991

CHARLESTON, WEST VIRGINIA 25330-2991

(304) 558-8500

CURRENT TAX RATE

.205

MOTOR FUEL EXCISE TAX

REFUND APPLICATION FOR RETAILERS OF

UNDYED KEROSENE SOLD FOR HOME HEATING USE

(FROM A BLOCKED PUMP)

PLEASE PROVIDE A NAME AND TELEPHONE NUMBER OF SOMEONE

AVAILABLE 8:30 A.M. – 4:30 P.M. TO DISCUSS THIS APPLICATION

FEIN/WV IDENTIFICATION NUMBER

NAME:

637-UP REGISTRATION NUMBER (ISSUED BY IRS)

(

)

NAME

TELEPHONE NUMBER INCLUDING AREA CODE

ADDRESS (CHECK WILL BE MAILED TO THIS ADDRESS)

PERIOD COVERED BY APPLICATION:

FROM: _______________________ TO: __________________________

Refund Application is available for All Gallons of Tax-Paid KEROSENE sold to consumers for HOME HEATING USE (from a blocked pump)

NOTE: IN ORDER TO RECEIVE REFUND, SEE INSTRUCTIONS FOR QUALIFICATION REQUIREMENTS

PART 1

FUEL ACCOUNTABILITY

Fuel Accountability

Please Read Instructions On Back Carefully. Incomplete forms

GALLONS

OFFICE USE

will be returned and will cause a delay in your refund.

A. Opening Inventory

(Must agree with closing inventory on last application))

B. Total Gallons Purchased During Period –

(Receipts must be

maintained for a period of 3 years and available upon request by Tax Commissioner)

C. Total Gallons

(Add Lines A plus B)

D. Closing Inventory

(Use as opening inventory on next application)

E. Total Gallons to Account for

(Line C less D)

F. Gallons Sold for On-Highway Use

(not refundable)

G. Gallons Sold for Home Heating Use

( Line E less Line F) (refundable)

PART 2.

H.

GALLONS CLAIMED FOR REFUND

(Line G)

Computation of

I. TOTAL REFUND DUE

$

Refund

(Multiply Line H by .205)

Caution

Read this application before signing. Presenting a fraudulent claim constitutes a felony.

:

Claimant sold the clear kerosene at a tax-excluded price, repaid the amount of tax to the buyer, or obtained written consent of the buyer

to make the claim. For line I, claimant has a statement, if required, that contains: the date of sale, name and address of the buyer, and

the number of gallons of kerosene sold to the buyer.

I certify that, to the best of my knowledge, this claim is accurate and complete.

__________________

SIGNATURE__________________________________________________TITLE________________________________________DATE

Sworn to and subscribed before me this ______ day of _____________, 20___

DEPARTMENT USE ONLY

Seal of Officer Taking Affidavit

AMOUNT OF REFUND $ _________________________

_______________________________________________________________

Notary Public

GALLONS OF KEROSENE _______________________

County of ___________________________ State ______________________

APPROVED BY: _______________________________

My commission expires on the ________ day of __________________, 20___

DATE APPROVED: _____________________________

SERIAL NUMBER : _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2