Form Wv/mitc-1 - Credit For Manufacturing Investment

ADVERTISEMENT

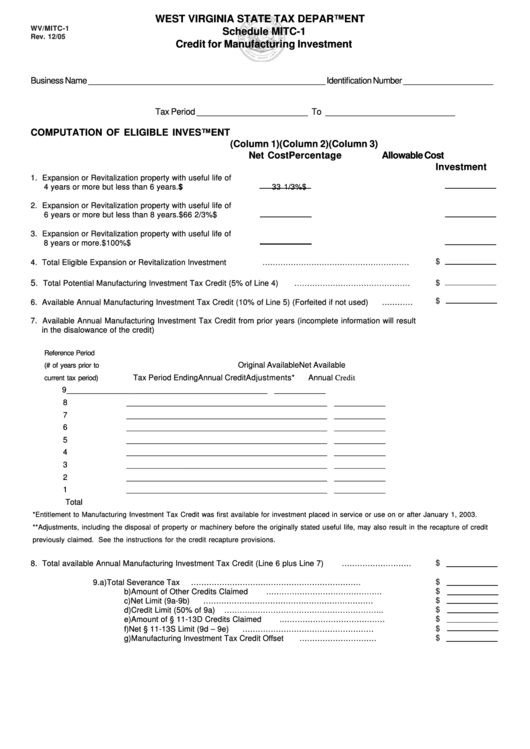

WEST VIRGINIA STATE TAX DEPARTMENT

WV/MITC-1

Schedule MITC-1

Rev. 12/05

Credit for Manufacturing Investment

Business Name _____________________________________________________ Identification Number ____________________

Tax Period ________________________ To ____________________________

COMPUTATION OF ELIGIBLE INVESTMENT

(Column 1)

(Column 2)

(Column 3)

Net Cost

Percentage

Allowable Cost

Investment

1. Expansion or Revitalization property with useful life of

4 years or more but less than 6 years.

$

33 1/3%

$

2. Expansion or Revitalization property with useful life of

6 years or more but less than 8 years.

$

66 2/3%

$

3. Expansion or Revitalization property with useful life of

8 years or more.

$

100%

$

$

4. Total Eligible Expansion or Revitalization Investment

…………………………………………………

5.

Total Potential Manufacturing Investment Tax Credit (5% of Line 4)

………………………………………

$

$

6. Available Annual Manufacturing Investment Tax Credit (10% of Line 5) (Forfeited if not used)

…………

7. Available Annual Manufacturing Investment Tax Credit from prior years (incomplete information will result

in the disalowance of the credit)

Reference Period

Original Available

Net Available

(# of years prior to

Tax Period Ending

Annual Credit

Adjustments*

Annual Credit

current tax period)

9

______________

_________________

____________ ___________

8

______________

_________________

____________ ___________

7

______________

_________________

____________ ___________

6

______________

_________________

____________ ___________

5

______________

_________________

____________ ___________

4

______________

_________________

____________ ___________

3

______________

_________________

____________ ___________

2

______________

_________________

____________ ___________

1

______________

_________________

____________ ___________

Total

*Entitlement to Manufacturing Investment Tax Credit was first available for investment placed in service or use on or after January 1, 2003.

**Adjustments, including the disposal of property or machinery before the originally stated useful life, may also result in the recapture of credit

previously claimed. See the instructions for the credit recapture provisions.

$

8. Total available Annual Manufacturing Investment Tax Credit (Line 6 plus Line 7)

………………………

$

9.

a)

Total Severance Tax

…………………………………………………………

$

b)

Amount of Other Credits Claimed

………………………………………

$

c)

Net Limit (9a-9b)

…………………………………………………………....

$

d)

Credit Limit (50% of 9a)

……………………………………………………..

$

e)

Amount of § 11-13D Credits Claimed

..…………………………………

$

f)

Net § 11-13S Limit (9d – 9e)

……………………………………………....

$

g)

Manufacturing Investment Tax Credit Offset

.....…………………………

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3