Form Gr-1040es - Estimated Individual Income Tax

ADVERTISEMENT

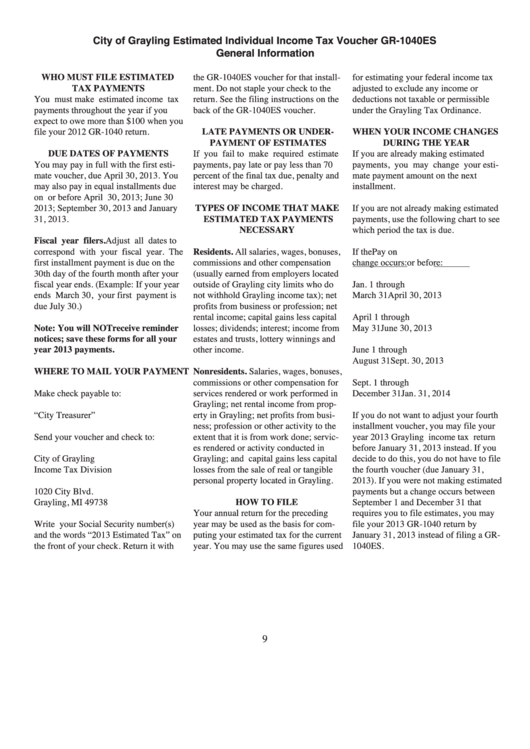

City of Grayling Estimated individual income tax Voucher Gr-1040ES

General information

WHO MUST FILE ESTIMATED

the GR-1040ES voucher for that install-

for estimating your federal income tax

TAX PAYMENTS

ment. Do not staple your check to the

adjusted to exclude any income or

You must make estimated income tax

return. See the filing instructions on the

deductions not taxable or permissible

payments throughout the year if you

back of the GR-1040ES voucher.

under the Grayling Tax Ordinance.

expect to owe more than $100 when you

file your 2012 GR-1040 return.

LATE PAYMENTS OR UNDER-

WHEN YOUR INCOME CHANGES

PAYMENT OF ESTIMATES

DURING THE YEAR

DUE DATES OF PAYMENTS

If you fail to make required estimate

If you are already making estimated

You may pay in full with the first esti-

payments, pay late or pay less than 70

payments, you may change your esti-

mate voucher, due April 30, 2013. You

percent of the final tax due, penalty and

mate payment amount on the next

may also pay in equal installments due

interest may be charged.

installment.

on or before April 30, 2013; June 30

2013; September 30, 2013 and January

TYPES OF INCOME THAT MAKE

If you are not already making estimated

31, 2013.

ESTIMATED TAX PAYMENTS

payments, use the following chart to see

NECESSARY

which period the tax is due.

Fiscal year filers. Adjust all dates to

correspond with your fiscal year. The

Residents. All salaries, wages, bonuses,

If the

Pay on

first installment payment is due on the

commissions and other compensation

change occurs:

or before:

30th day of the fourth month after your

(usually earned from employers located

fiscal year ends. (Example: If your year

outside of Grayling city limits who do

Jan. 1 through

ends March 30, your first payment is

not withhold Grayling income tax); net

March 31

April 30, 2013

due July 30.)

profits from business or profession; net

rental income; capital gains less capital

April 1 through

Note: You will NOT receive reminder

losses; dividends; interest; income from

May 31

June 30, 2013

notices; save these forms for all your

estates and trusts, lottery winnings and

year 2013 payments.

other income.

June 1 through

August 31

Sept. 30, 2013

WHERE TO MAIL YOUR PAYMENT

Nonresidents. Salaries, wages, bonuses,

commissions or other compensation for

Sept. 1 through

Make check payable to:

services rendered or work performed in

December 31

Jan. 31, 2014

Grayling; net rental income from prop-

“City Treasurer”

erty in Grayling; net profits from busi-

If you do not want to adjust your fourth

ness; profession or other activity to the

installment voucher, you may file your

Send your voucher and check to:

extent that it is from work done; servic-

year 2013 Grayling income tax return

es rendered or activity conducted in

before January 31, 2013 instead. If you

City of Grayling

Grayling; and capital gains less capital

decide to do this, you do not have to file

Income Tax Division

losses from the sale of real or tangible

the fourth voucher (due January 31,

P.O. Box 549

personal property located in Grayling.

2013). If you were not making estimated

1020 City Blvd.

payments but a change occurs between

Grayling, MI 49738

HOW TO FILE

September 1 and December 31 that

Your annual return for the preceding

requires you to file estimates, you may

Write your Social Security number(s)

year may be used as the basis for com-

file your 2013 GR-1040 return by

and the words “2013 Estimated Tax” on

puting your estimated tax for the current

January 31, 2013 instead of filing a GR-

the front of your check. Return it with

year. You may use the same figures used

1040ES.

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3